In today’s fast-paced digital economy, the intersection of AI and financial management is not just a technological advancement but a game-changer for businesses across the globe. As organizations strive to adapt and thrive in an ever-changing market landscape, the integration of AI technologies into financial processes heralds a new era of efficiency, accuracy, and strategic decision-making. One of the most critical components of this transformation is the automation of data collection, which pushes the boundaries of traditional financial management practices.

AI digital transformation is not merely a trend; it represents a fundamental shift in how businesses operate. By leveraging AI technologies, organizations can streamline processes, extract actionable insights from data, and enhance overall productivity. In the realm of financial management, these changes are particularly pronounced. Automated data collection offers financial professionals the opportunity to focus on strategic initiatives rather than bogged down by manual entry and data reconciliation.

The future of financial management is undeniably tied to advancements in AI and data collection technologies. Empowered by these tools, finance teams can enhance accuracy, expedite reporting, and improve compliance with regulatory requirements. This transformation is evident in numerous use cases across various industries, emphasizing the importance of adapting financial strategies to incorporate AI-driven solutions.

## The Rise of Automated Data Collection

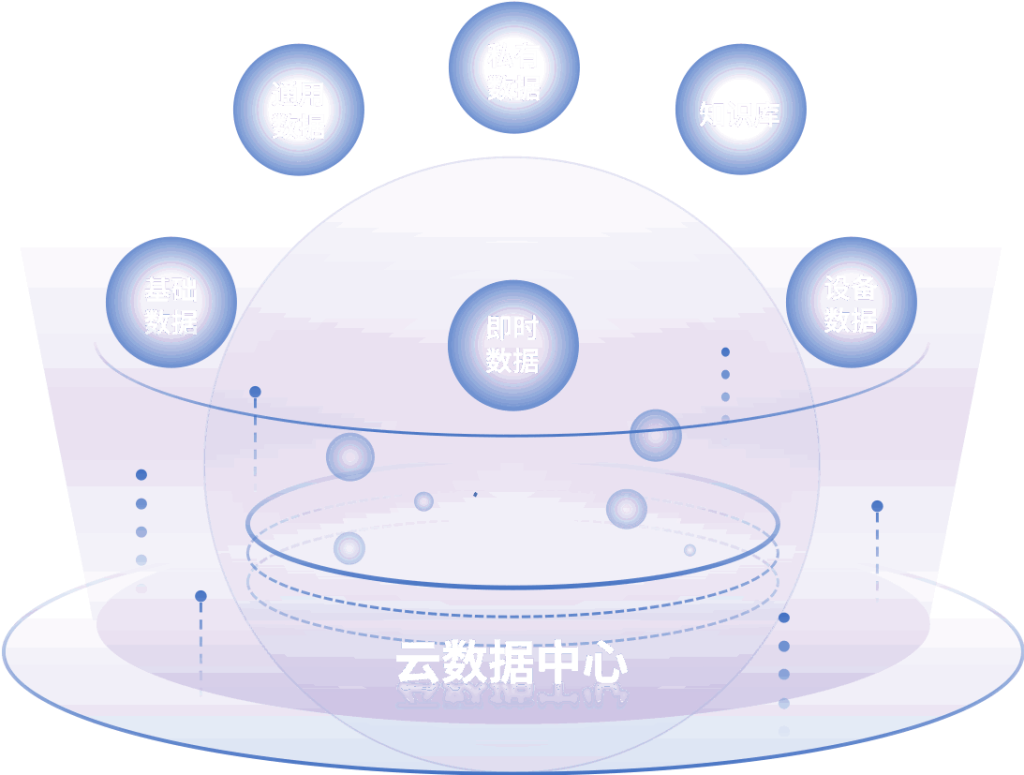

Automated data collection refers to the process of gathering and organizing data using advanced technologies without human intervention. This approach not only reduces human error but also accelerates the speed at which data is processed and analyzed. In financial management, the volume of data generated on a daily basis is staggering. From transaction records to expense reports, managing this flow of information can be overwhelming.

AI-driven automated data collection tools can help financial teams gather and analyze data from multiple sources seamlessly. By utilizing machine learning algorithms, these tools can identify patterns, trends, and anomalies in the data, enabling finance professionals to make data-driven decisions in real-time. For instance, organizations in the retail sector can automate the collection of inventory and sales data, allowing for faster reporting and analysis of financial performance.

Moreover, the financial services industry is leveraging automated data collection to enhance risk management practices. Financial institutions can monitor transactions in real-time, analyzing large datasets to identify potential fraud or compliance issues. By utilizing AI algorithms, institutions can detect anomalies that may indicate suspicious activity, thus safeguarding their assets and customers.

## Trends Driving AI in Financial Management

1. **Enhanced Data Analytics**: As companies gravitate towards data-driven decision-making, the demand for sophisticated analytics grows. AI-powered analytics tools allow financial professionals to gain deeper insights into their financial data, providing visibility into profit margins, cash flow, and expenditure patterns.

2. **Predictive Analytics**: Predictive AI algorithms can forecast future financial trends based on historical data. This capability empowers financial managers to make proactive decisions. For example, businesses can predict seasonal sales fluctuations and adjust their budgets accordingly.

3. **Robotic Process Automation (RPA)**: RPA technology is becoming increasingly popular in finance, handling repetitive and time-consuming tasks such as accounts payable and receivable. By automating these processes, finance teams can increase productivity and reduce the risk of errors associated with manual data entry.

4. **Real-Time Financial Monitoring**: Real-time data monitoring enables organizations to track their financial health continuously. By utilizing AI tools that provide instant insights into key performance indicators (KPIs), finance teams can react swiftly to emerging issues, optimize resource allocation, and capitalize on growth opportunities.

5. **Regulatory Compliance**: AI and automated data collection tools are increasingly used to ensure compliance with industry regulations. By automatically generating reports and tracking compliance metrics, businesses can avoid costly penalties and enhance their reputation for transparency.

## Industry Applications of AI in Financial Management

The application of AI in financial management is vast and varied, with industries harnessing its power to drive efficiencies. Below are some notable examples:

### 1. Banking and Financial Services

In the banking sector, AI applications are transforming how institutions assess credit risk and handle loan applications. By automating data collection and using algorithms to evaluate creditworthiness, banks can streamline the loan approval process and improve customer experience. AI-powered chatbots further enhance customer service by providing instant assistance to clients on financial queries.

### 2. Retail

Retailers are utilizing AI to automate inventory and sales data collection. With advanced analytics, businesses can optimize inventory levels, minimize stockouts, and adjust pricing strategies in real time based on consumer insights. This holistic view of financial data allows retailers to maximize profits and improve operational efficiency.

### 3. Healthcare

Healthcare organizations are also leveraging AI in financial management to streamline billing processes and reduce revenue cycle costs. Automated data collection can reduce discrepancies in billing, ensuring accurate coding and faster payment cycles. Moreover, advanced analytics help predict patient volume and financial performance, enabling healthcare providers to make informed strategic decisions.

### 4. Manufacturing

Manufacturers are turning to AI to analyze production data in relation to financial metrics. By automating the collection of cost data associated with production processes, companies can better understand the relationship between operational efficiency and profitability. Furthermore, predictive analytics can anticipate equipment failures, thereby minimizing downtime and associated financial losses.

## Technical Insights and Challenges

While the benefits of AI and automated data collection in financial management are significant, organizations must also navigate several challenges as they implement these technologies.

### Data Quality and Integration

One of the critical challenges facing businesses is data quality. AI algorithms rely heavily on high-quality, accurate data to produce reliable results. Organizations must invest in ensuring that their data sources are consistent and that data from disparate systems can be integrated seamlessly.

### Cybersecurity Concerns

The automation of data collection increases the risk of cyber threats. Financial data is particularly sensitive and valuable, making it a prime target for cybercriminals. Companies must implement robust security measures to protect their financial data and ensure compliance with data protection regulations.

### Change Management

The transition to AI-powered automated data collection requires a cultural shift within the organization. Change management strategies must be employed to help employees adapt to new technologies and workflows. Involving employees in the process and highlighting the benefits of AI can mitigate resistance and enhance adoption.

## Conclusion

The integration of AI in financial management, particularly through automated data collection, offers unparalleled opportunities for organizations to enhance their operations and make informed strategic decisions. The financial management landscape is evolving rapidly, driven by the need for efficiency, accuracy, and compliance in an ever-changing environment. As businesses embrace AI-driven tools, they position themselves not only to thrive in today’s market but also to navigate future challenges confidently.

To stay ahead in this competitive landscape, organizations must understand the principles of AI and digital transformation while effectively managing the accompanying challenges. Those that harness the power of automated data collection will ultimately emerge as leaders in their industries, equipped to harness actionable insights and drive sustainable growth.

### Sources:

1. Brynjolfsson, E., & McAfee, A. (2014). “The Second Machine Age: Work, Progress, and Prosperity in a Time of Brilliant Technologies”. W.W. Norton & Company.

2. Deloitte. (2021). “The Future of Financial Management: AI-Driven Insights for Actionable Decisions”.

3. McKinsey & Company. (2020). “How COVID-19 Has Pushed Companies over the Technology Tipping Point – and Transformed Business Forever”.

4. PricewaterhouseCoopers (PwC). (2020). “AI in Financial Services: The Road Ahead”.