As the world continues to evolve at a breakneck pace, the financial sector is undergoing a transformative shift driven by technological advancement. At the forefront of this change is the rise of AI Operating Systems (AIOS), revolutionizing not just how financial institutions operate but also how they interact with customers. This article explores the role of AIOS in financial systems, examining trends, innovations, and practical applications that are shaping the industry’s future.

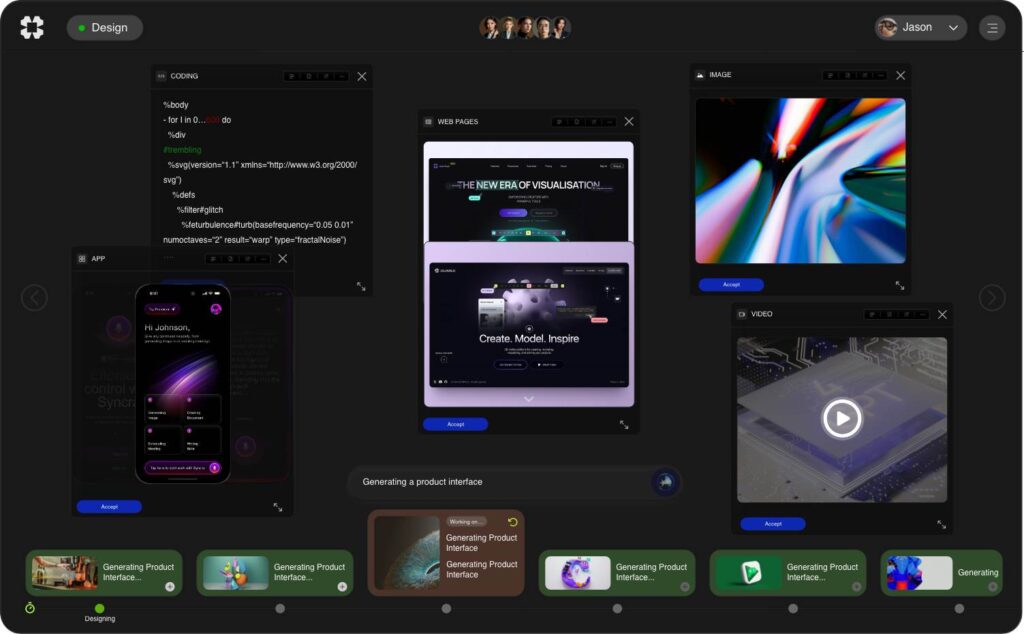

The concept of an AI Operating System (AIOS) centers around the integration of artificial intelligence into core software systems. Unlike traditional operating systems that manage hardware resources, AIOS uses machine learning, natural language processing, and data analytics to streamline processes, enhance decision-making, and deliver personalized services. In the financial sector, AIOS can drive efficiencies, reduce risks, and improve customer engagement.

One major trend is the increasing fusion of AIOS in financial systems—an integration that allows financial institutions to leverage vast amounts of data to create predictive models. By employing AI algorithms, organizations can anticipate market trends, optimize investment strategies, and improve lending practices. According to a report by Accenture, banks that embrace AI technologies could increase their profitability by up to 40% by 2030 (Accenture, 2021).

.

**Navigating Risk Management with AIOS in Financial Systems**

Risk management has become a critical focus for financial institutions. In this context, AIOS can automate the analysis of credit risk, operational risk, and market risk, providing faster and more accurate assessments. Traditional risk management methods often rely on historical data and human intuition, which can be slow and error-prone. However, with AIOS, organizations can analyze real-time data streams to identify patterns and predict outcomes more effectively.

For instance, AI-driven credit scoring can utilize vast datasets, including transactional data, social media activity, and alternative data sources, to create a more holistic view of a borrower’s creditworthiness. This capability allows financial systems to extend credit to underbanked populations who may be overlooked by traditional assessment methods. A study by FICO revealed that AI-powered credit scoring models led to a 30% reduction in default rates (FICO, 2022).

Moreover, AIOS can enhance fraud detection mechanisms in financial systems. By employing machine learning algorithms, institutions can analyze transaction patterns in real time, flagging unusual activities that may indicate fraudulent behavior. This proactive approach can significantly reduce financial losses and improve customer trust in financial systems.

.

**AI-Driven OS Virtualization: Transforming Financial Infrastructure**

An essential component of AIOS in the financial sector is AI-driven OS virtualization. This technology allows financial institutions to create virtual environments where applications can interact seamlessly. By leveraging AI algorithms, institutions can optimize resource allocation, reduce operational costs, and enhance scalability.

AI-driven OS virtualization is particularly useful in cloud-based financial solutions, where agility and flexibility are paramount. Financial systems can seamlessly scale their operations during peak times, such as market openings or major financial announcements, without investing in additional hardware. This benefit not only enhances operational efficiency but also allows banks to deliver services faster.

Virtualization also plays a key role in improving data security within financial institutions. Traditional systems with multiple physical servers can become vulnerable to attacks if not appropriately managed. By virtualizing their OS, institutions can consolidate data, enhance security protocols, and create isolated environments for sensitive applications, protecting them from external threats.

Furthermore, AI-driven OS virtualization presents an opportunity for financial institutions to explore innovative services like sandboxing. Sandboxed environments allow institutions to test new products and services without disrupting existing operations. By utilizing AI to analyze the results of these test cases, financial organizations can bring ideas to market faster with reduced risk.

.

**Real-World Use Case: JPMorgan Chase and AIOS Implementation**

JPMorgan Chase serves as a compelling example of how an AI Operating System can be integrated into financial operations. The banking giant has invested significantly in AI capabilities, creating a dedicated AI research and development group. This unit focuses on leveraging machine learning to improve customer service, risk management, and operational processes.

One notable application is the use of AI for contract analysis, where automated systems analyze legal documents and extract relevant information. This automation not only accelerates the contract processing timeline but also minimizes human error, saving time and resources. AIOS facilitates quick adjustments and continuous learning as new contracts are processed, allowing the technology to evolve.

Moreover, JPMorgan Chase employs AI to power its trading systems. By utilizing advanced algorithms, the bank can analyze market data to execute trades at optimal prices. This application enhances the bank’s trading efficiency, helping them maintain a competitive edge in an increasingly complex market.

In addition, the institution’s implementation of AI for customer service, through chatbots and virtual assistants, demonstrates how AIOS can personalize customer experiences. These tools leverage natural language processing to understand and respond to customer inquiries, improving engagement and satisfaction.

.

**Challenges and the Road Ahead for AIOS in Financial Systems**

While the potential of AIOS in financial systems is immense, challenges remain. Regulatory issues surrounding data privacy and security pose significant hurdles for widespread adoption. Financial institutions must ensure compliance with privacy laws, such as the General Data Protection Regulation (GDPR), while harnessing the power of AI.

Moreover, there is ongoing debate regarding the ethical use of AI in financial applications. Institutions need to establish guidelines to ensure that AI-driven decisions do not perpetuate biases or lead to discriminatory practices. Developing transparent algorithms that can be explained to clients is essential to maintaining trust in AI-powered financial systems.

Investment in talent and infrastructure is also crucial. As the demand for AI specialists continues to rise, financial institutions must compete to attract top talent. Additionally, upgrading existing systems to support AIOS requires significant financial investment and a clear strategic vision.

.

**Conclusion: Embracing the AI-Driven Future of Finance**

The emergence of AI Operating Systems (AIOS) is set to revolutionize the financial landscape, providing transformative opportunities for organizational growth, customer engagement, and operational efficiency. From enhancing risk management practices to optimizing virtualized environments, the applications of AIOS in financial systems are vast and impactful.

As financial institutions continue to explore the potential of AIOS, it is vital to address challenges surrounding ethical considerations and regulatory compliance. Embracing transparency and investing in talent will be key to unlocking the full value of AI-driven innovations.

In this brave new world shaped by AIOS, financial services organizations have an opportunity to lead the charge towards a more efficient, secure, and customer-centric future. The time to act is now, as the financial industry stands on the cusp of a digital revolution that promises to redefine the very essence of banking and finance.

**Sources:**

1. Accenture. (2021). “How AI Can Help Banks Increase Profitability by 40%.”

2. FICO. (2022). “AI-Powered Credit Scoring: Reducing Default Rates by 30%.”

3. JPMorgan Chase. (2022). “Leveraging AI for Contract Analysis and Trading.”