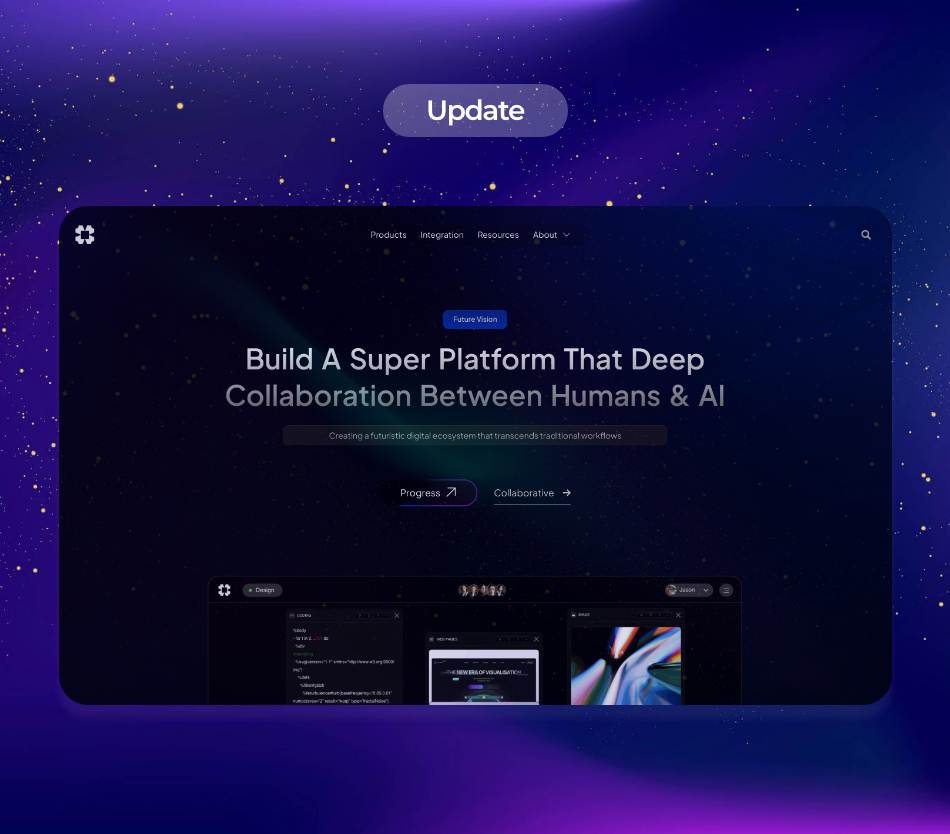

In an era where technology is advancing at an unprecedented pace, the integration of Artificial Intelligence Operating Systems (AIOS) into various sectors is reshaping our daily lives. Smart homes are no longer a futuristic concept but a present reality, and financial systems are becoming increasingly sophisticated as they harness the power of AI. Real-time AI-driven decision-making is at the core of these transformations, bringing about significant efficiencies and user-friendly experiences. This article will delve into how AIOS is revolutionizing smart homes and financial systems, with emphasis on real-time decision-making and industry applications.

.Smart homes are increasingly equipped with sensors, cameras, and internet connectivity, allowing homeowners to control their environments seamlessly. AIOS serves as the central nervous system for these smart devices, enabling them to communicate and optimize user interactions if programmed effectively. Through advanced algorithms, AIOS can learn individual habits and preferences, offering personalized experiences that enhance comfort and security. For instance, smart thermostats can adjust temperatures based on occupancy patterns, while smart security systems can use facial recognition to differentiate between family members and intruders.

.A recent report from Statista predicts that the global smart home market will exceed $135 billion by 2025, emphasizing the soaring demand for AI-driven technologies. Companies such as Google, Amazon, and Apple are playing a significant role in this growth through innovative AIOS platforms like Google Home, Amazon Alexa, and Apple HomeKit. These platforms simplify the integration of various devices from different manufacturers, leveraging AI to create cohesive systems that can automate daily routines.

.AIOS is not only transforming homes but also revolutionizing the financial sector. Financial systems are increasingly complex, handling vast amounts of data that require immediate analysis for effective decision-making. AIOS in financial applications introduces enhanced capabilities such as fraud detection, risk assessment, and marketing analytics. For example, machine learning algorithms can analyze transaction patterns to detect anomalies, helping institutions prevent fraud before it occurs.

.A study conducted by McKinsey reveals that financial institutions that adopt AI-driven strategies in risk management can improve their operational efficiency by as much as 20%. AIOS can evaluate creditworthiness by analyzing a more comprehensive set of data points than traditional methods, allowing lenders to make informed decisions quickly and efficiently. This not only speeds up the loan approval process but also expands the potential customer base by considering applicants who may not qualify under conventional criteria.

.Another notable application of AIOS in finance is the use of real-time AI-driven decision-making in trading. Algorithmic trading platforms utilize advanced AI to analyze market data and execute trades within milliseconds. This capability allows traders to capture opportunities that human traders might miss. Several hedge funds and investment houses have significantly benefited from implementing AI-driven trading systems, achieving higher returns on investments and lower operational costs.

.Integration of AIOS in both smart homes and financial systems hinges on one vital aspect: real-time decision-making. The ability to process vast amounts of data instantaneously and derive actionable insights empowers users to make informed decisions. In smart homes, this could mean adjusting lighting based on the time of day or predicting energy costs based on historical usage. In financial applications, it could involve spotting an investment opportunity or mitigating risks before they escalate.

For instance, consider a homeowner who has incorporated AIOS into their property. The system evaluates energy consumption in real-time and suggests the best time to run appliances based on electricity rates. It could also auto-adjust the security system if unfamiliar movement is detected, ensuring safety without waiting for human intervention. Conversely, in the financial world, real-time AI-driven systems can alert traders to fluctuations in stock prices or provide insights into emerging market trends as they occur.

.As industries continue to adopt AIOS, they face challenges such as data security, ethical concerns, and integration complexities. According to a 2023 report by Deloitte, one of the biggest hurdles for businesses is ensuring that AI systems adhere to privacy regulations and ethical standards. This concern is exceptionally pertinent in financial applications where personal and sensitive data is managed. Implementing robust cybersecurity measures and maintaining transparency in AI decision-making processes will be critical in overcoming these challenges.

.Furthermore, as AIOS becomes prevalent, industry professionals must familiarize themselves with the technology to harness its benefits fully. Upskilling human resources to manage and evaluate AI-driven systems will not only promote efficiency but also ensure that businesses remain competitive in a rapidly evolving landscape. Continuous learning and adaptation will be essential as new AI technologies emerge, and older systems evolve.

.A case in point is the integration of AIOS in smart home ecosystems where user privacy is paramount. Brands are adopting privacy-first designs, ensuring that data collected from users is secured and used ethically. By building trust through transparency and consent, these companies can create an environment where consumers feel safe utilizing AIOS.

.As we head towards a more automated and AI-driven future, it’s essential to acknowledge the foundational technologies that facilitate these advancements. Machine learning, natural language processing, and cloud computing are just a few of the technical insights that underpin AIOS. These technologies enable real-time data processing and insights, forming the backbone of smart and financial systems.

.In conclusion, the rise of AIOS in both smart homes and financial systems is transforming the way individuals interact with technology. Real-time AI-driven decision-making is a powerful tool that enhances efficiency, personalization, and user satisfaction. As the demand for these technologies increases, stakeholders must address the challenges associated with integration, ethics, and security to create sustainable solutions. The potential benefits of AIOS are enormous, and those who embrace this technology will undoubtedly enhance their quality of life and optimize their operations in an increasingly complex world.

**Sources:**

1. Statista. “Smart Home Market by Segment Worldwide from 2015 to 2025.” [Link](https://www.statista.com)

2. McKinsey & Company. “How AI is Reshaping the Financial Services Industry.” [Link](https://www.mckinsey.com)

3. Deloitte. “AI and Ethics: The Path to Responsible AI Deployment.” [Link](https://www2.deloitte.com)

4. Fan, H. (2023). “The Role of AI Operating Systems in Modern Financial Services.” Journal of Financial Technology.

5. Kelly, S. (2023). “The Future of Home Automation: Integrating AI and Internet of Things.” Smart Home Today.

As we witness the ongoing evolution of AIOS, we are reminded that these developments are not merely about technology but about improving everyday life and making processes more efficient and intuitive. The holistic transformation brought about by AIOS in smart homes and financial systems illustrates a significant step toward a more automated, intelligent, and user-centric world.