The rise of Artificial Intelligence (AI) has revolutionized various industries, but its profound impact on financial management cannot be overstated. As organizations increasingly integrate AI optimization into their operations, tools like INONX AI are leading the charge. This article delves into the latest trends, industry applications, and technical insights surrounding the use of AI in financial management, showcasing how it reshapes the landscape for businesses today.

.

**The Evolution of AI in Financial Management**

Artificial Intelligence has transformed countless sectors, and financial management is no exception. Historically, financial professionals relied heavily on manual processes, spreadsheets, and basic analytics. However, with the integration of AI tools, organizations now harness data-driven insights, enabling faster and more accurate decision-making. In recent years, finance departments worldwide have started leveraging AI to automate mundane tasks, reduce human error, and enhance overall efficiency.

.

As AI technologies evolve, so does their optimization capability. AI optimization refers to the process of fine-tuning these technologies to achieve maximum efficiency and performance. Organizations are realizing that merely adopting AI is not enough; they need to optimize these systems continuously to capture the full potential of their investments.

.

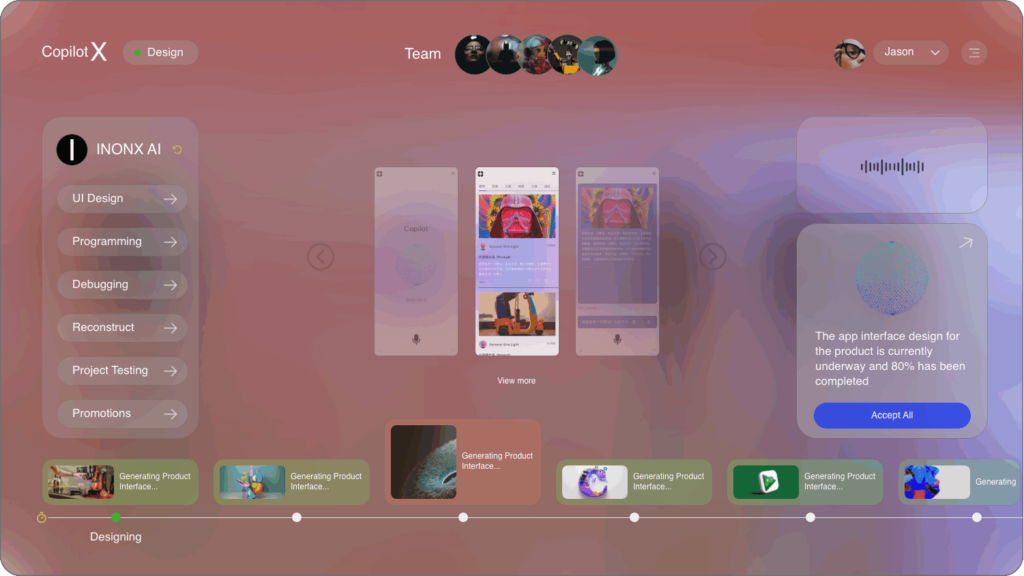

**Introducing INONX AI: A Game Changer in Financial Analytics**

One such tool at the forefront of this transformation is INONX AI. This innovative platform equips finance teams with cutting-edge AI-driven optimization solutions, streamlining the complexities associated with financial management. INONX AI employs advanced algorithms and machine learning techniques to process vast amounts of financial data, providing verifiable insights and predictive analytics for more informed decision-making.

.

What sets INONX AI apart is its robust capability to optimize financial processes by minimizing inefficiencies and enhancing workflow accuracy. From automated report generation to intelligent forecasting, the platform is designed to adapt and learn from ongoing data inputs, effectively improving its performance over time.

.

**Key Trends: The Role of AI Optimization in Finance**

The integration of AI optimization technologies like INONX AI into financial management is driven by several key trends:

1. **Automation of Repetitive Tasks**: One of the most significant advantages of AI optimization is the automation of mundane tasks such as data entry, invoice generation, and financial reporting. This not only reduces the potential for human error but also allows finance professionals to focus on strategic activities that add greater value to the organization.

2. **Predictive Analytics**: Predictive analytics powered by AI optimizations enable businesses to forecast financial performance based on historical data and current market trends. This forward-looking approach empowers organizations to make proactive decisions and mitigate risks.

3. **Enhanced Data Visualizations**: Financial data can often be overwhelming, making it difficult to derive meaningful insights. AI tools like INONX AI utilize advanced data visualization techniques to present complex information in an easily digestible format, helping finance teams and stakeholders grasp critical insights quickly.

4. **Risk Management and Fraud Detection**: AI optimization enhances risk management capabilities by identifying patterns indicative of potential fraud or anomalies within financial transactions. This enables organizations to take timely actions and protect their assets effectively.

5. **Real-Time Reporting**: The demand for real-time insights into financial performance is growing. AI-powered platforms can process data on-the-fly, allowing finance teams to generate instant reports reflecting the latest developments, which significantly enhances decision-making agility.

.

**Industry Applications of AI in Financial Management**

AI optimization has found applications across various sectors, fundamentally altering how organizations conduct financial operations. Here are a few noteworthy examples:

1. **Banking Sector**: Banks leverage AI technologies to enhance customer service through chatbots and virtual assistants, manage risk more efficiently, and streamline loan approval processes by accurately analyzing applicant data. INONX AI’s capabilities allow banks to optimize these processes, resulting in improved operational efficiency.

2. **Investment Management**: Portfolio managers utilize AI-driven predictive analytics to optimize investment decisions. By forecasting market trends and gaining insights from large datasets, investment firms can make informed trading strategies. INONX AI can assist in identifying which assets to invest in or divest based on predictive models.

3. **Insurance**: The insurance industry is harnessing AI to enhance underwriting processes and claims management. AI optimization can enable insurers to assess risk more accurately and mitigate potential losses. INONX AI’s analytical tools offer insights into customer behavior, which can inform more precise underwriting decisions.

4. **Retail**: Retail companies are employing AI optimization to manage their supply chains, forecast inventory needs, and optimize pricing strategies. Financial planning and analysis tools, like INONX AI, help retailers align their financial decisions with market demand.

5. **Corporate Financial Management**: From budgeting to forecasting, corporate finance departments are leveraging AI to streamline processes. AI optimization facilitates the automation of routine tasks and allows for sophisticated simulations to assess the financial impact of different business scenarios.

.

**Technical Insights: Leveraging AI Optimization**

The technical framework underpinning AI optimization in financial management consists of several core components:

1. **Machine Learning Algorithms**: Machine learning enables AI systems to learn from data, enabling them to make predictions and recommendations based on historical patterns. Algorithms can be categorized into supervised learning, unsupervised learning, and reinforcement learning, each serving specific use cases.

2. **Natural Language Processing (NLP)**: NLP is critical for processing unstructured data, such as email communications and customer inquiries. By integrating NLP into financial management systems, organizations can extract valuable insights from text data and improve customer interactions.

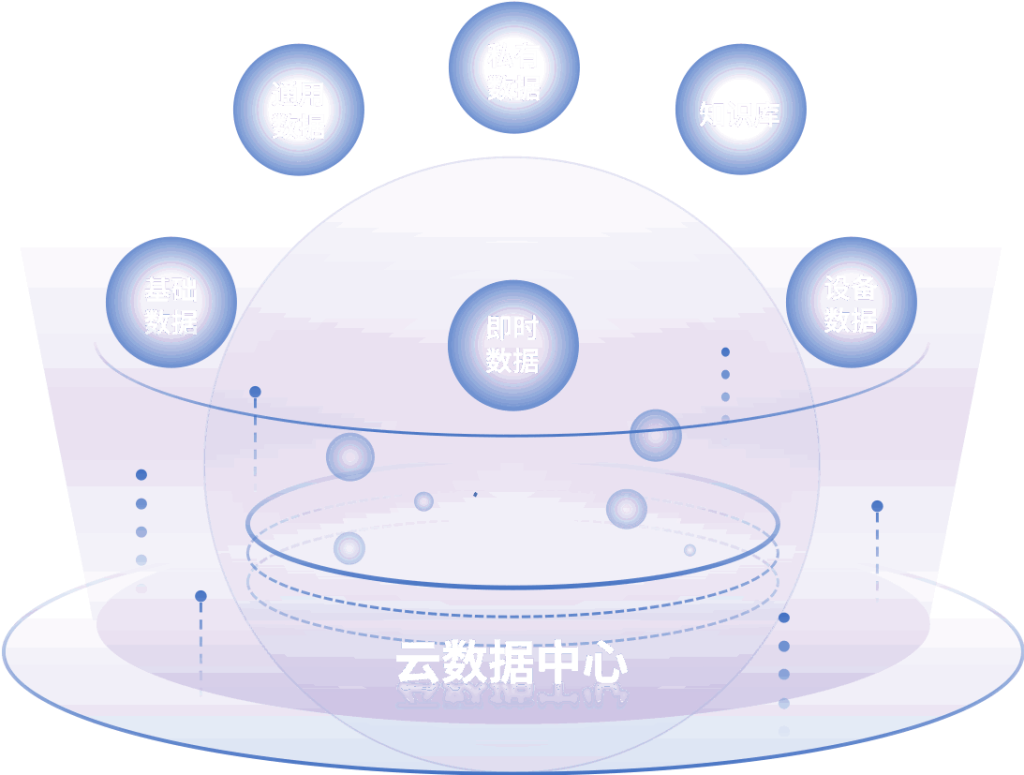

3. **Data Integration and Management**: For optimal performance, AI tools require access to high-quality, clean data. Effective data integration solutions are vital to ensure disparate data sources can be combined seamlessly, providing a robust foundation for AI optimization processes.

4. **Cloud Computing**: The scalability and flexibility afforded by cloud computing platforms enable organizations to manage vast datasets and deploy AI tools without the constraints of traditional IT infrastructures. INONX AI operates in a cloud-based environment, enhancing accessibility and collaboration across teams.

5. **Continuous Learning and Improvement**: One of the critical aspects of AI optimization is its capacity for continuous learning. The system’s performance can improve over time based on real-time feedback, enabling organizations to adapt their strategies dynamically.

.

**Use Case: INONX AI in Action**

To illustrate how INONX AI can drive excellence in financial management, consider a mid-sized retail company struggling with inventory forecasting. The company’s traditional methods were inaccurate, leading to stockouts and excess inventory, which hurt profit margins.

By implementing INONX AI, the company was able to integrate historical sales data, seasonality patterns, and external market conditions into its forecasting models. The AI-driven solution continually learned from new sales trends and inventory data, leading to improved accuracy in demand forecasting.

As a result, the company enjoyed minimized stockouts, optimized inventory levels, and enhanced cash flow. Additionally, finance teams benefited from automated reporting and insights into key performance indicators, informing better business decisions.

.

**Conclusion: Embracing AI Optimization for Future Financial Management**

The integration of AI optimization into financial management represents a transformative trend that organizations can no longer afford to ignore. Tools like INONX AI deliver innovative solutions that streamline processes, enhance decision-making, and promote data-driven strategies.

As the financial landscape becomes increasingly complex, the ability to leverage AI optimization will differentiate forward-thinking companies. Embracing these technologies is essential for organizations seeking efficiency, accuracy, and competitive advantage in a rapidly evolving marketplace. Adaptation and continuous optimization will be key to thriving in the future of financial management, making AI an indispensable asset for companies of all sizes.

.

**Sources**:

1. “The Impact of AI on Financial Services,” Deloitte Insights.

2. “AI Applications in Finance: What You Need to Know,” Accenture.

3. “How AI is Transforming Financial Management,” Forbes.

4. “The Future of AI in Financial Services,” McKinsey & Company.

5. “AI Optimization: Enabling Intelligent Decision-Making,” PWC.