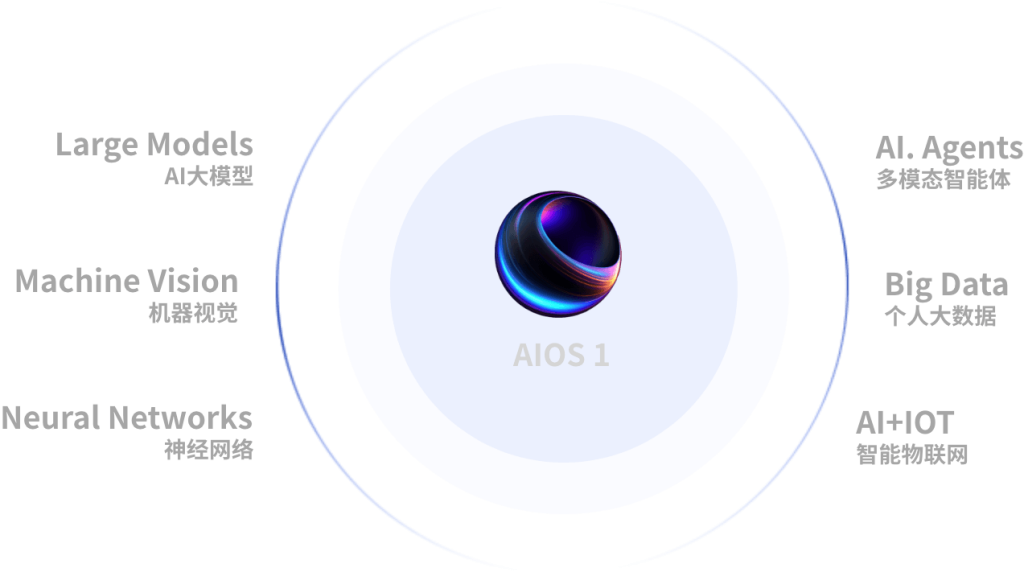

In recent years, artificial intelligence (AI) has evolved from a futuristic concept into a present-day necessity across various industries. Companies are increasingly adopting AI-driven technologies to enhance operational efficiency, innovate product design, and optimize financial strategies. This article explores the latest trends, applications, and insights related to AI predictive maintenance solutions, AI-assisted design tools, and AI’s impact on the financial technology landscape.

.

**AI Predictive Maintenance Solutions: A Paradigm Shift in Operational Efficiency**

In manufacturing and asset-intensive industries, unexpected equipment failure can lead to substantial downtime and financial losses. Enter AI predictive maintenance solutions, which leverage machine learning algorithms and data analytics to predict equipment failures before they occur. These solutions analyze operational data, sensor readings, and historical maintenance records to identify patterns that precede a breakdown.

By moving from a reactive to a proactive maintenance strategy, organizations can significantly reduce maintenance costs and enhance asset reliability. A report by McKinsey & Company states that predictive maintenance can reduce maintenance costs by 20-25% and increase equipment uptime by up to 10%.

Several industries are harnessing the power of AI in this arena. For instance, in the aerospace sector, airlines such as Lufthansa are utilizing predictive maintenance to optimize flight operations and improve safety. Sensors on aircraft provide real-time data that AI algorithms analyze, predicting when a component is likely to fail and ensuring timely maintenance, thus enhancing passenger experience and reducing operational costs.

.

In the energy sector, companies like Siemens are applying AI predictive maintenance solutions to wind turbines. By continuously monitoring turbine health, operators can predict failures, schedule maintenance during low energy demand, and improve overall operational efficiency. As organizations continually seek to optimize their resources, the integration of AI predictive maintenance is likely to be a significant trend moving forward.

.

**AI-assisted Design Tools: Redefining Creativity and Efficiency**

The creativity and efficiency of product design are experiencing a technological renaissance, thanks to AI-assisted design tools. These innovative applications facilitate the design process by providing designers with data-driven insights and automation capabilities.

For instance, generative design software enables designers to input parameters like materials, manufacturing methods, and cost constraints, after which the AI generates numerous design alternatives that meet the specified requirements. This form of AI accelerates the design process, potentially creating solutions that human engineers might not have considered.

Industries such as automotive and aerospace are leading the charge with AI-assisted design tools. Companies like Autodesk have developed generative design software that revolutionizes how engineers approach product development. By allowing the AI to explore a vast number of design possibilities, engineers can iterate faster, reduce material waste, and create lightweight, durable components.

.

A notable example is Boeing’s use of AI in designing aircraft parts. The aerospace giant reported that, through the use of AI-assisted design tools, it managed to produce parts that are structurally sound while also using 70% less material, resulting in significant cost savings and environmental benefits.

Furthermore, the use of AI in design isn’t confined to manufacturing. The fashion industry is also tapping into AI’s potential. Companies like Stitch Fix employ AI to analyze customer preferences and design clothes that cater to individual tastes, reducing the time from concept to market.

.

As AI-assisted design tools continue to evolve, they are expected to redefine the design landscape, enabling companies to innovate faster while also minimizing costs and environmental impact.

.

**AI in Financial Technology (FinTech): Revolutionizing Finance**

Artificial intelligence is making waves in the financial technology sector, fundamentally altering how businesses and consumers interact with financial services. AI’s applications in FinTech are vast, including fraud detection, credit scoring, algorithmic trading, and personalized banking services. The ability to analyze large datasets in real-time allows companies to gain insights that were previously unattainable.

One of the most prominent uses of AI in FinTech is in fraud detection. Traditional systems often struggle to keep pace with the increasingly sophisticated tactics employed by fraudsters. AI algorithms, on the other hand, can quickly learn and adapt to new patterns, making them invaluable for identifying potential fraudulent transactions. For instance, Mastercard and Visa have integrated AI-driven fraud detection systems that monitor billions of transactions in real-time, flagging any anomalies for further investigation.

Moreover, AI is also transforming the lending process. Traditional credit scoring methods are often slow and limited in scope. In contrast, AI models can analyze a myriad of data points, including social media activity and transaction history, to assess an applicant’s creditworthiness more accurately. Companies like ZestFinance utilize these AI-driven models to provide wider access to credit for underserved populations while minimizing risk.

.

Automated trading strategies powered by AI are taking the investment landscape by storm as well. Firms such as Betterment and Wealthfront leverage AI to create personalized investment portfolios based on individual risk tolerance and financial goals. These platforms monitor market conditions and dynamically adjust portfolios, allowing users to benefit from optimized financial strategies without needing extensive knowledge of the market.

AI is also enhancing customer service in banking through conversational AI and chatbots. Organizations like Bank of America use AI-powered chatbots, such as Erica, to assist customers in managing their financial inquiries and transactions, providing timely support around the clock.

.

As the FinTech landscape becomes increasingly competitive, companies that harness AI’s capabilities effectively are likely to lead the charge in transforming financial services, ultimately achieving improved customer satisfaction and operational excellence.

.

**Conclusion: The Future of AI-Driven Solutions**

The integration of AI predictive maintenance solutions, AI-assisted design tools, and AI in financial technology is reshaping industries, driving innovative solutions that are more efficient, cost-effective, and customer-focused. As technology continues to advance, companies that leverage these AI-driven tools will not only keep pace but will likely set new standards in operational efficiency, product innovation, and financial services.

Training AI systems with diverse and high-quality data will be the backbone of these advancements, ensuring that businesses can continuously improve and adapt to changing market demands. As we advance, the intersection of artificial intelligence and industry applications will pave the way for a more efficient, innovative, and ultimately smarter future.

In conclusion, the trends in AI-driven technologies signify a revolutionary shift across various sectors, showcasing how far we have come, and hinting at the potentials that lie ahead. The journey is just beginning.

.

**Sources:**

1. McKinsey & Company: “The Future of Predictive Maintenance”

2. Autodesk: “Generative Design: The Future of Making Things”

3. Boeing: “Boeing and AI: Transforming Aerospace Design”

4. Mastercard: “Fraud Detection Solutions Using AI”

5. ZestFinance: “Utilizing AI in Credit Risk Assessment”

6. Bank of America: “How Chatbots Are Helping Customers”

7. Harvard Business Review: “How AI is Revolutionizing Industries Across the Board”