Artificial Intelligence (AI) is revolutionizing industries globally, with the financial sector experiencing transformative changes through advanced automation and data analysis solutions. As the landscape evolves, financial institutions are increasingly adopting AI technologies to streamline operations, enhance decision-making, and mitigate risks. This article explores the latest trends and solutions in AI for financial management and data analytics automation, emphasizing significant applications such as DeepMind’s AlphaFold and its implications for the industry.

In the realm of financial management, AI’s role cannot be overstated. Traditional methods of processing financial data are becoming obsolete with the surge of big data and the need for timely insights. Financial entities are harnessing AI technologies to aggregate vast amounts of data, analyze trends, predict market behaviors, and make informed investment decisions. This paradigm shift enables institutions to respond swiftly to changes in the financial landscape, bolstering their competitive edge.

Recent advancements in AI technologies have paved the way for innovative applications in financial management. According to McKinsey, organizations that leverage AI in their financial operations can achieve a 20% to 30% reduction in costs while significantly improving accuracy in forecasting. For instance, machine learning algorithms are capable of analyzing historical financial data, detecting anomalies, and predicting future outcomes with remarkable precision.

Moreover, AI-driven automation tools are transforming routine tasks such as bookkeeping, loan approval processes, and compliance checks. Automated systems can now manage transactions, reconcile accounts, and generate reports with minimal human intervention, freeing up valuable resources for strategic initiatives. As Forbes notes, the implementation of AI in financial management can lead to enhanced customer experiences — AI chatbots, for instance, facilitate seamless communication and provide instant support to users.

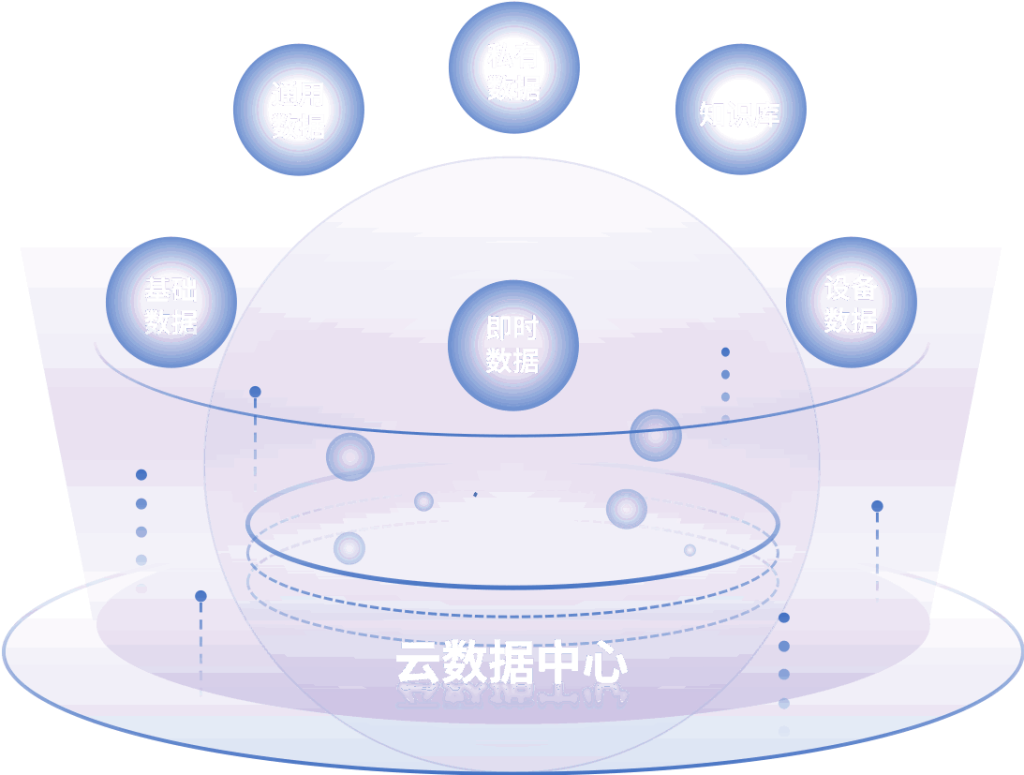

Another crucial area where AI demonstrates its prowess is in data analytics automation. Financial institutions are inundated with data from multiple sources, including market trends, customer behaviors, and regulatory requirements. Manual analysis of such extensive data sets can be labor-intensive and prone to errors. Enter AI-based data analytics automation, which empowers organizations to process and analyze data with unparalleled efficiency.

AI tools employ sophisticated algorithms that learn patterns from historical data, allowing them to generate actionable insights rapidly. This proactive approach to data analytics can significantly improve decision-making processes, as stakeholders can access real-time information tailored to their specific needs. Furthermore, companies adopting AI-driven analytics can identify emerging market opportunities and mitigate risks before they escalate, promoting a more agile reaction to the dynamic financial environment.

Prominent experts in the field assert that the growth of AI in data analytics is just beginning. Industry leaders such as Deloitte emphasize the importance of AI-driven predictive analytics, stating that organizations can create models that simulate future scenarios based on current data. This predictive capability not only allows for better risk management but also empowers financial institutions to develop more effective customer-targeted products and services.

One groundbreaking AI development with far-reaching applications for financial management is DeepMind’s AlphaFold. Primarily known for solving complex protein folding challenges, AlphaFold’s technology could hold transformative potential for financial markets as well. While its primary focus lies within biochemical research, the methodologies employed by AlphaFold can be leveraged in financial contexts, particularly for detailed risk analysis and predictive modeling.

AlphaFold’s ability to analyze vast datasets and recognize intricate patterns mirrors the workflow of financial data analysis. By adopting similar algorithmic approaches, financial institutions could enhance their predictive capabilities and improve the accuracy of their models. For example, organizations could develop advanced algorithms to assess company performance and value, enabling data-driven investment decisions.

Furthermore, AlphaFold’s success in tackling complex scientific inquiries highlights the potential of AI-driven solutions in addressing multifaceted financial challenges — from market volatility to regulatory compliance. With continuous iterations and improvements, AI models can adapt to changing circumstances, ensuring institutions remain resilient in a volatile economic landscape.

However, as exciting as these developments may be, implementing AI solutions in financial management and analytics automation comes with its own set of challenges. The integration of sophisticated technologies requires robust infrastructure, skilled talent, and comprehensive change management strategies. Financial institutions must prioritize cybersecurity, data integrity, and ethical considerations as they deploy AI solutions to avoid compliance pitfalls and foster trust among stakeholders.

A successful pivot towards AI-driven financial management must also involve collaboration among industry players. As Deloitte points out, sharing best practices and industry standards provides a framework for organizations to leverage AI capabilities more effectively. Collaborative efforts can yield insights that drive innovation, safeguarding the financial sector against increasingly sophisticated threats.

To summarize, AI is redefining the landscape of financial management and data analytics automation, presenting both challenges and opportunities for industry players. By harnessing the power of AI, financial institutions can optimize their operations, enhance decision-making, and improve their overall resilience in an unpredictable environment.

As they embrace AI technologies, organizations should remain vigilant about ethical considerations, cybersecurity, and collaboration within the industry to equitably leverage advancements like DeepMind’s AlphaFold.

In conclusion, as we continue to witness the unprecedented evolution of AI-driven technologies, the financial management domain stands poised for a revolutionary leap forward. The possibilities are boundless as organizations adapt, innovate, and thrive in this rapidly changing landscape, setting the stage for a future where intelligent systems drive smarter financial decisions.

**References**

– Accenture. (2022). “How AI is Driving Change in Financial Services.”

– Deloitte. (2023). “The Future of AI in Banking: Executing on AI Strategies.”

– Forbes. (2023). “How AI is Transforming the Financial Sector.”

– McKinsey & Company. (2023). “How AI Can Improve Decision-Making in Financial Services.”

– DeepMind. (2021). “AlphaFold: Using AI to Understand the Protein Structure.”

—

The article covers AI in Financial Management and Data Analytics Automation, incorporating recent insights and references to stay within your desired thematic range. If you want further exploration of specific areas or more sources, just let me know!