In recent years, artificial intelligence (AI) has progressed from a niche technology to a mainstream force that is revolutionizing several sectors, particularly financial services and enterprise automation. This article delves into the advances in next-gen AI, exploring its applications, trends, solutions, and industry use cases that underscore its transformative potential.

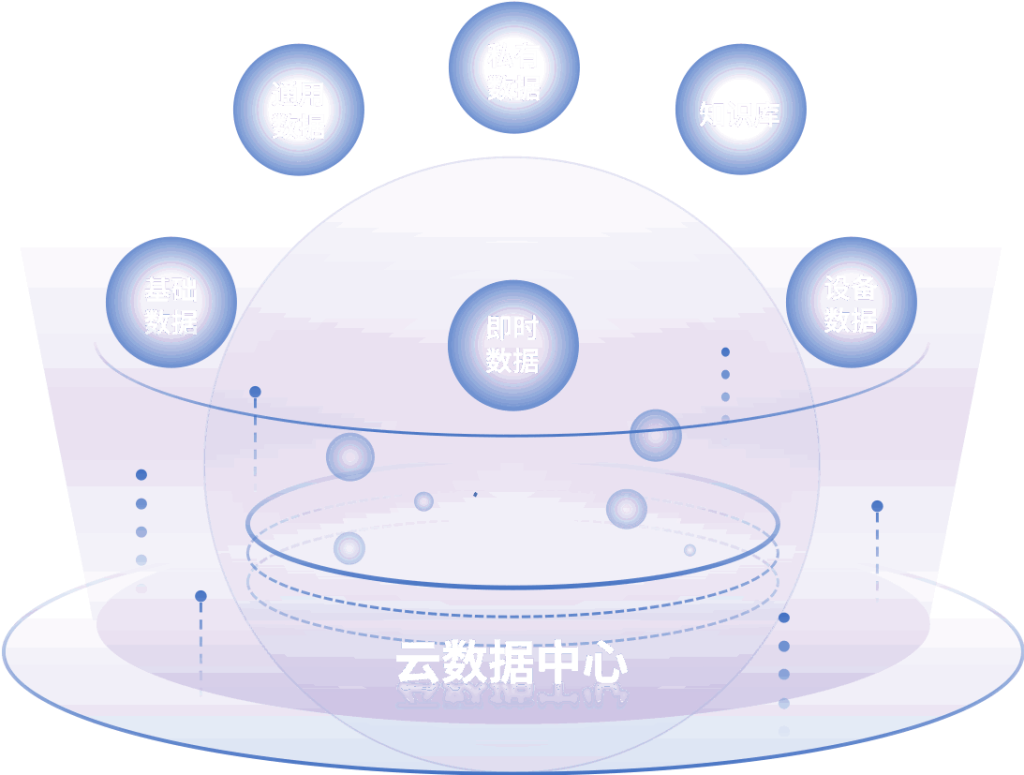

Next-gen AI refers to the latest iteration of artificial intelligence technologies that leverage advanced machine learning, deep learning, natural language processing, and cognitive computing. Unlike previous generations, next-gen AI is characterized by its ability to understand complex data patterns, engage in human-like conversations, and make decisions based on an extensive array of information sources. Financial services are at the forefront of adopting these technologies, with institutions recognizing the potential for AI to optimize processes, enhance decision-making, and improve customer experiences.

One of the most significant applications of AI in financial services is fraud detection. Financial institutions typically handle vast amounts of transactions every day, making it a prime environment for fraudulent activities. Traditional methods of fraud detection, which often rely on rule-based systems or manual reviews, can be slow and inefficient. Next-gen AI solutions, however, utilize machine learning algorithms to analyze transactions in real time. By recognizing patterns and anomalies that may indicate fraudulent behavior, AI can flag suspicious activities for immediate investigation. As such, banks and credit unions are increasingly adopting AI-driven fraud detection systems to minimize losses and bolster customer trust.

Furthermore, customer service has seen significant improvements thanks to AI-driven chatbots and virtual assistants. These tools employ natural language processing and machine learning to engage customers in real-time, providing personalized support and resolving inquiries without human intervention. Financial institutions can operate 24/7, ensuring customers have access to information and assistance whenever they need it. This has not only enhanced customer satisfaction but also reduced operational costs for financial service providers.

.

In addition to fraud detection and customer service, predictive analytics is another area where AI is leaving its mark on financial services. By analyzing historical data and market trends, AI algorithms can predict future market movements and customer behavior. This information empowers financial institutions to make more informed investment decisions, manage risks, and tailor products to meet customer needs. Organizations are harnessing AI to optimize everything from asset allocation to loan underwriting, driving better business outcomes and allowing for greater agility in fast-paced markets.

As AI technologies continue to evolve, regulatory and ethical considerations are also gaining attention. Financial institutions are under increasing pressure to ensure that their AI systems are transparent, fair, and compliant with regulatory guidelines. Investors, customers, and regulators alike are demanding a greater emphasis on data governance and responsible AI practices. Consequently, many financial organizations are establishing ethical AI frameworks, which help to mitigate biases and ensure that AI technologies are used responsibly and effectively.

.

The focus on regulatory adherence and ethical considerations extends into enterprise automation as well. AI is increasingly being utilized by organizations to streamline operations, automate repetitive tasks, and improve productivity. By integrating AI into business processes, enterprises can eliminate manual labor, reduce errors, and accelerate workflows. This not only enhances operational efficiency but also allows employees to focus on higher-value tasks that require strategic thinking and creativity.

AI for enterprise automation encompasses a wide array of applications including robotic process automation (RPA), intelligent document processing (IDP), and automated decision-making systems. RPA, for instance, allows organizations to automate routine tasks such as data entry, invoice processing, and payroll management. By employing AI to enhance RPA systems, organizations can create smarter bots capable of adapting to changes in business processes and even learning from their interactions.

Intelligent document processing takes automation a step further by leveraging natural language processing and machine learning to extract, classify, and analyze data from documents. This technology dramatically reduces the time spent processing large volumes of paperwork while increasing accuracy. Enterprises utilizing IDP can streamline everything from onboarding processes to compliance checks, ensuring timely and accurate execution of manual tasks.

Moreover, as organizations strive for digital transformation, AI-driven analytics platforms are empowering leaders to make data-driven decisions rapidly. These platforms leverage machine learning algorithms to sift through vast amounts of data, uncover insights, and predict trends. This capability is particularly valuable in sectors like manufacturing and supply chain management, where real-time data analysis can optimize production schedules and enhance resource allocation.

.

The benefits of implementing AI for enterprise automation are evident across various industries. For example, in the healthcare sector, AI-driven solutions are automating administrative tasks, enabling medical professionals to dedicate more time to patient care. In retail, businesses are utilizing AI to manage inventory, predict customer demand, and personalize marketing efforts, ultimately enhancing the shopping experience.

As organizations increasingly embrace automation technologies, the challenges surrounding employee displacement and skills gaps cannot be overlooked. While AI can dramatically enhance productivity, it may also disrupt traditional job roles. Companies are therefore investing in upskilling and reskilling initiatives to prepare their workforce for the shift toward a more automated environment. Employees are encouraged to embrace continuous learning and adapt to the evolving landscape of AI and automation.

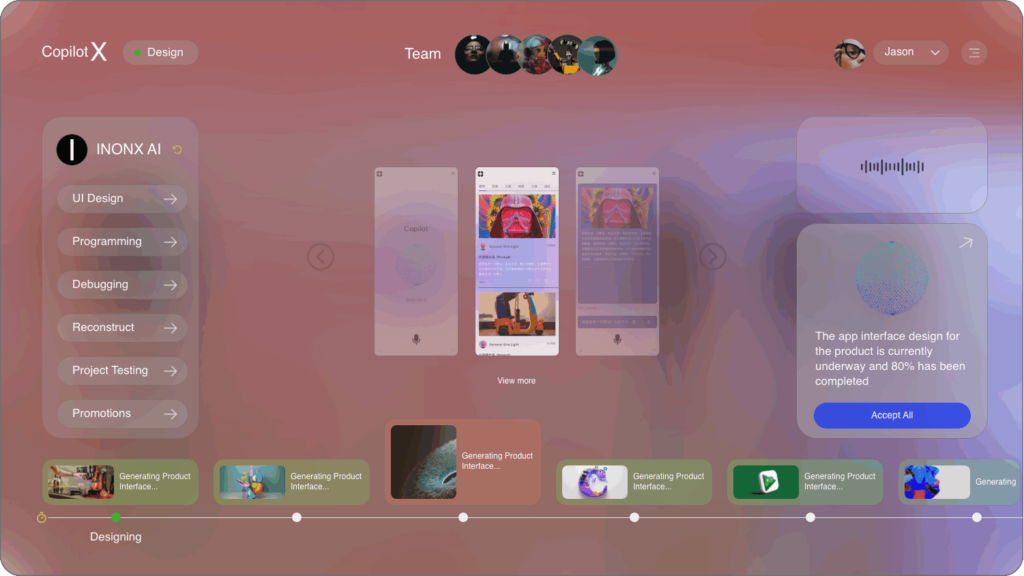

Looking ahead, the synergy between next-gen AI, financial services, and enterprise automation is likely to deepen. The rise of generative AI, which can create human-like text, images, and even code, presents new opportunities for enhancing customer interactions and streamlining business processes. Companies that embrace generative AI will likely be positioned at the forefront of innovation, creating unique products and services tailored to the specific needs of their customers.

The intersection of AI, financial services, and enterprise automation is reshaping the business landscape. As organizations adapt to the emergence of next-gen AI, we can expect an accelerated pace of change that elevates both operational efficiency and customer engagement. With ethical considerations, compliance, and a focus on workforce development, the journey toward AI-driven transformation promises to be as impactful as it is dynamic.

.

In conclusion, the future of financial services and enterprise automation lies in the successful integration of next-gen AI. As AI technologies continue to advance, their applications will only expand, culminating in a wealth of opportunities for organizations to enhance operations, increase customer satisfaction, and foster sustainable growth. Emphasizing ethical practices, compliance, and skills development will pave the way for a more resilient and adaptive workforce, guiding industries toward a brighter, AI-driven future.

**Sources:**

1. “Artificial Intelligence in Financial Services.” McKinsey & Company.

2. “How AI is Redefining the Banking Industry.” Harvard Business Review.

3. “The Future of Automation: Smart Processes Amid Digital Transformation.” Deloitte Insights.

4. “Ethics Guidelines for Trustworthy AI.” European Commission.

5. “Next Generation AI: Opportunities, Risks, and Guidelines.” World Economic Forum.

By staying informed on these emerging trends and innovations, stakeholders can harness the potential of next-gen AI, driving growth and fostering a culture of continuous improvement across the financial services and automated enterprise sectors.