The financial technology (FinTech) sector is undergoing a transformation, driven primarily by advancements in artificial intelligence (AI) and automation technologies. This article explores the synergy of AI automation and intelligent workflows in FinTech, providing insights into industry applications, current trends, and effective solutions that financial institutions are adopting.

.

**The FinTech Landscape: Innovations Shaping the Future**

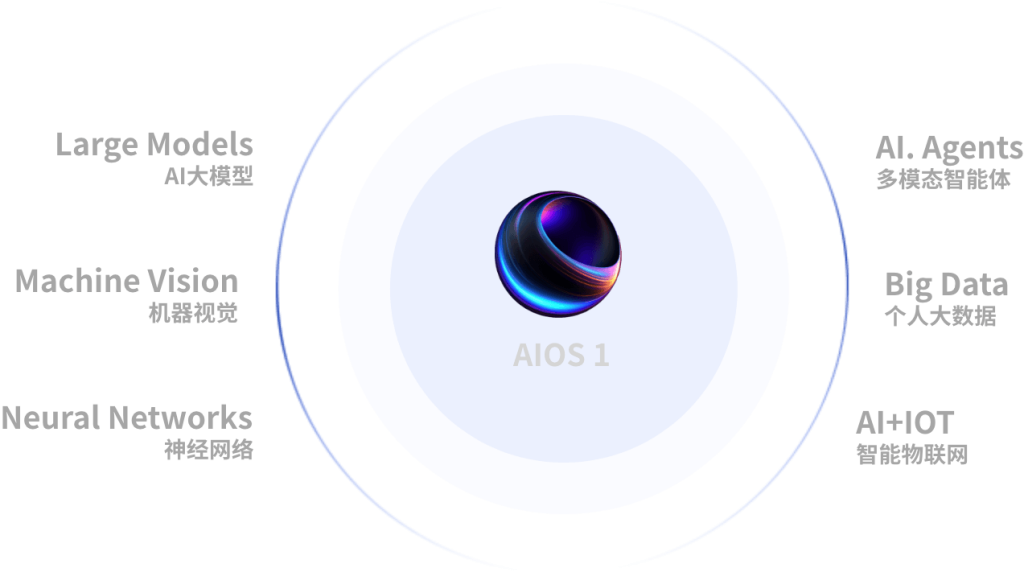

FinTech refers to the integration of technology into offerings by financial services companies to improve their use of financial services. The landscape is crowded with innovations such as blockchain, mobile banking apps, robo-advisors, and more recently, artificial intelligence. AI automation has emerged as a pivotal element within this ecosystem, enhancing the capabilities of financial institutions to process information, optimize customer experiences, and ensure compliance.

.

**AI Automation: Enhancing Operational Efficiency**

AI automation in FinTech is about leveraging AI technologies to automate repetitive tasks that were previously performed manually. Routine operations, such as data entry, transaction monitoring, and customer service inquiries, can now be addressed through intelligent systems that learn and adapt over time.

For instance, companies like UiPath are setting benchmarks in AI-driven automation. Their software robots can handle mundane tasks effectively, allowing human employees to focus on more complex decision-making processes. Sources indicate that businesses employing AI in their operations have seen productivity increases of up to 40%, substantially reducing operational costs.

.

**Intelligent Workflows: Streamlining Processes**

Intelligent workflows are another fundamental aspect of the FinTech revolution. These workflows utilize AI not only to automate tasks but also to improve the decision-making process. By employing machine learning algorithms, systems can analyze vast amounts of data to provide actionable insights.

A prominent example of intelligent workflows is the use of AI in risk assessment. Financial institutions are now able to analyze customer data comprehensively, assess creditworthiness, and make real-time lending decisions. Companies like ZestFinance have utilized AI to help lenders assess risk levels accurately and provide loans to a broader pool of applicants without increasing default rates.

.

**The Intersection of AI and Compliance: A Game Changer for FinTech**

One of the significant challenges facing financial institutions today is regulatory compliance. The burden of compliance can be staggering, with financial entities facing stiff penalties for non-compliance. AI automation helps mitigate these risks, providing tools that streamline compliance processes.

Through machine learning, AI systems can be programmed to monitor transactions and flag any suspicious activities in real time. Companies like ComplyAdvantage are implementing AI-driven solutions that scan enormous data sets to ensure compliance with anti-money laundering (AML) regulations. According to recent studies, organizations that have adopted AI for compliance have reported a significant reduction in compliance-related costs—by up to 30%.

.

**Customer Experience: Personalization through AI**

Furthermore, AI automation and intelligent workflows also play a crucial role in enhancing customer experiences within the FinTech sector. Through predictive analytics, AI can provide personalized recommendations, making banking services not just transactions but tailored experiences.

An excellent example is Robo-advisors, which utilize AI to offer personalized investment strategies based on individual risk profiles. Wealthfront and Betterment are leading the charge by providing users with personalized portfolio management options—disrupting traditional wealth management models. According to a report by Deloitte, the Robo-advisory market is expected to manage $13 trillion by the year 2025, underscoring the demand for automated, personalized financial services.

.

**Real-World Use Cases: AI in Action**

Several FinTech companies have successfully integrated AI automation and intelligent workflows into their operations, demonstrating the practical applications of these technologies.

1. **Fraud Detection at PayPal**: PayPal employs advanced AI algorithms to detect and prevent fraud in real time. By analyzing transaction patterns and user behaviors, the company can effectively flag anomalous activities, leading to significant reductions in financial loss.

2. **Automated Financial Advising**: Schwab Intelligent Portfolios leverages AI to provide automated financial advice without charging advisory fees. This service utilizes algorithms to assess client goals, risk tolerance, and current portfolios, allowing for effective wealth management at a lower cost.

3. **Customer Support at Stripe**: Stripe has integrated AI-driven chatbots that handle customer inquiries 24/7. This not only improves response times but also frees up human resources for more intricate customer issues requiring a personalized touch.

.

**The Future of AI in FinTech: Challenges and Opportunities**

While the benefits of AI automation and intelligent workflows in FinTech are substantial, several challenges remain. Data privacy and security concerns are at the forefront, especially with the increased dependence on data for AI algorithms. Additionally, there is a continuous need for human oversight to ensure that AI systems do not propagate biases present in training data.

However, the potential for innovation is enormous. As technology evolves, we expect to see a broader adoption of AI solutions, specializing in sectors like insurtech (insurance technology) and regtech (regulatory technology). Experts forecast that AI could account for $1 trillion in annual savings for the financial services industry by 2030.

.

**Conclusion: Embracing Change in FinTech**

The fusion of AI automation and intelligent workflows represents a significant leap forward for the FinTech sector. As organizations embrace these transformative technologies, they unlock new levels of efficiency, enhance engagement, and create robust security frameworks.

Staying competitive in the ever-evolving financial landscape will require constant adaptation and innovation. Companies that leverage AI effectively will not only improve their operational processes but also redefine customer interactions within the industry. The FinTech revolution is just beginning, and embracing these technological advancements is the key to thriving in the future.

.

**Sources:**

1. UiPath. “Automate Your Business with AI-Powered Robotic Process Automation.”

2. ComplyAdvantage. “The Cost of Non-Compliance: Understanding Key Risks in the Financial Services Industry.”

3. Deloitte. “The Future of Robo-Advisors: A $13 Trillion Opportunity.”

4. Schwab Intelligent Portfolios. “Smart Investment Solutions at Zero Advisory Fees.”

5. PayPal. “Fraud Prevention: Advanced Machine Learning Techniques.”

Through these technological innovations, financial institutions are poised to reshape the industry landscape, leading to a smarter, more efficient, and ultimately more consumer-friendly financial environment.