In recent years, the integration of Artificial Intelligence (AI) into various industries has transformed traditional processes, paving the way for innovative solutions and enhanced efficiencies. In particular, the fields of data analytics and insurance automation are experiencing an exciting surge in AI applications. This article explores the latest trends, updates, and real-world use cases, shedding light on how AI is reshaping these sectors.

.

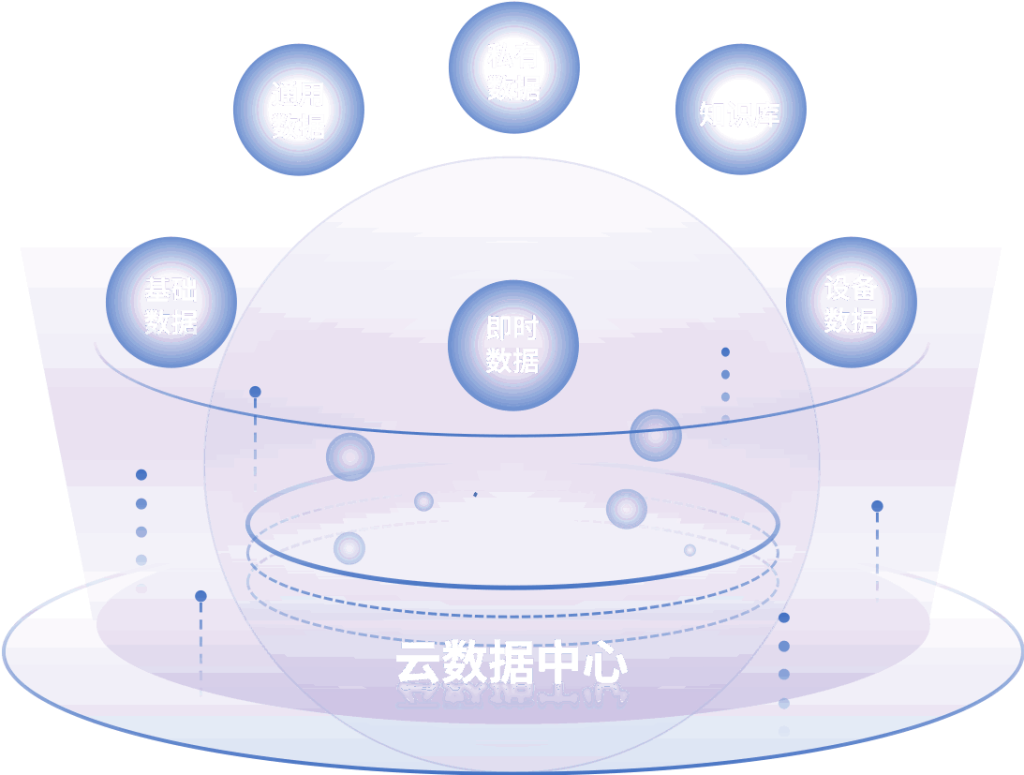

### The Rise of AI in Data Analytics

Artificial Intelligence in data analytics is revolutionizing how businesses process and interpret data. Traditional methods of data analysis often rely on time-consuming manual processes, where teams sift through vast amounts of data to extract meaningful insights. However, with machine learning algorithms, data processing, and analysis have become significantly faster and more accurate. AI tools can identify patterns, predict outcomes, and provide actionable insights with unprecedented speed.

.

AI’s capability to process large data sets is especially valuable as the volume of data generated continues to grow exponentially. According to recent statistics, our global data production is expected to reach 175 zettabytes by 2025 (Statista, 2022). AI-powered analytics platforms like Google Cloud’s BigQuery and Microsoft Azure Synapse Analytics utilize advanced machine learning techniques to handle complex queries in real time, allowing organizations to respond swiftly to market changes.

.

### Key Trends in AI Data Analytics

One of the significant trends shaping the AI data analytics landscape is the advent of augmented analytics. This approach leverages AI and machine learning to automate data preparation and insight discovery. As a result, businesses can empower non-technical users to utilize analytics tools, democratizing data access across teams. For instance, platforms like Tableau and Power BI have integrated AI features that suggest the best visualizations and interpretations based on the data uploaded.

.

Another emerging trend is the increased focus on explainable AI (XAI). With AI’s growing role in decision-making, stakeholders demand transparency regarding how models generate insights. Companies like IBM and Google are advancing XAI methodologies to clarify the workings of their algorithms, enabling organizations to understand the rationale behind AI-driven recommendations.

.

### AI in Insurance Automation: Streamlining Operations

In the insurance sector, AI is redefining how companies manage operations, assess risks, and serve customers. By automating repetitive tasks, insurers can enhance operational efficiency, reduce costs, and ultimately improve customer experiences. The use of AI-powered chatbots for customer service exemplifies this transformation. These bots can handle common inquiries without human intervention, allowing representatives to focus on more complex issues.

.

Additionally, AI algorithms are employed for claims processing. Traditionally, assessing claims has been a labor-intensive process that can lead to delays and errors. However, with AI-driven solutions, insurers can streamline this process. For example, data from photographs submitted by claimants can be analyzed through computer vision techniques to assess damages quickly and accurately. This not only expedites the claims process but also enhances customer satisfaction by providing faster resolutions.

.

### Key Applications of AI in Insurance

The application of AI in underwriting is another critical aspect of insurance automation. Historically, underwriting required extensive manual input and meticulous analysis of historical data. Today, AI algorithms can analyze vast amounts of data from diverse sources, including social media, financial records, and even IoT devices. This enables underwriters to make more informed decisions and price policies accurately based on real-time risk assessments.

.

Moreover, predictive analytics is becoming increasingly prevalent in fraud detection within the insurance landscape. Insurers are leveraging AI algorithms to scrutinize claimant behaviors and identify anomalies indicative of fraudulent activities. Companies like Lemonade employ AI-driven models to flag suspicious claims in real time, significantly reducing the instances of fraud and ensuring that legitimate claims are paid promptly.

.

### The Role of OpenAI in Advancing Analytics and Automation

OpenAI, as a leader in the field of artificial intelligence, has made significant strides in developing models that can enhance both data analytics and insurance automation processes. The OpenAI GPT models, such as GPT-3 and the more advanced GPT-4, are capable of performing complex language tasks, generating insights, and assisting in data interpretation. These models are increasingly being integrated into business workflows, enabling organizations to harness AI for improved decision-making.

.

For instance, the use of OpenAI’s language models allows companies to automate the generation of reports, create predictive models based on historical data, and even assist in customer interactions through natural language processing applications. This not only enhances productivity but also helps organizations derive insights from data in a more consumer-friendly manner.

.

### Industry Use Cases: Real-World Success Stories

Several companies have already harnessed AI in data analytics and insurance automation to achieve substantial results. For example, Progressive Insurance employs AI-driven predictive analytics models to optimize its pricing strategies. By analyzing past customer data alongside real-time market conditions, the company can adjust premiums efficiently, maintaining a competitive edge while ensuring profitability.

.

In the retail sector, Walmart utilizes AI-equipped analytics tools to manage inventory levels effectively. By analyzing customer purchasing patterns and external factors like weather data, Walmart can predict demand for products with greater accuracy, reducing waste and improving the shopping experience for customers.

.

Furthermore, in the healthcare industry, insurance providers are beginning to leverage AI for customer engagement and risk assessment. For example, Cigna uses AI to analyze patient data to anticipate needs and tailor health insurance offerings, fostering a more personalized approach to customer service.

.

### Future Perspectives on AI in Data Analytics and Insurance

The future of AI in data analytics and insurance automation holds exciting possibilities. As technology continues to advance, AI models will become even more sophisticated, capable of understanding context and nuance far beyond current capabilities. The potential for integration with emerging technologies, such as Blockchain for enhanced security and transparency in insurance transactions, signals a new era of innovation.

.

Ethical considerations surrounding AI also continue to gain importance. As data privacy regulations become more stringent and consumers express concerns over data security, organizations will need to navigate these challenges carefully while harnessing the benefits of AI.

.

### Conclusion

AI is undeniably shaping the future of data analytics and insurance automation. Businesses that embrace these technologies stand to gain a competitive advantage through enhanced efficiencies, accelerated insights, and improved customer engagement. As organizations continue to implement AI-driven solutions, it will be crucial to prioritize ethical considerations and transparency, ensuring responsible use of technology that benefits all stakeholders.

.

As we look to the future, it is evident that AI will remain a cornerstone in the evolution of industries, driving innovation and transforming how we approach complex challenges in both data analytics and insurance.

.

### References:

– Statista. (2022). Global data production forecast from 2010 to 2025. Retrieved from [Statista](https://www.statista.com/statistics/871513/worldwide-data-created)

– IBM. (2023). What is Explainable AI? Retrieved from [IBM](https://www.ibm.com/cloud/learn/explainable-ai)

– Progressive Insurance. (2023). About Progressive. Retrieved from [Progressive](https://www.progressive.com)

– Walmart. (2023). How Walmart Uses Data Analytics to Optimize Inventory. Retrieved from [Walmart](https://corporate.walmart.com)

– Cigna. (2023). Business and Innovation. Retrieved from [Cigna](https://www.cigna.com)