In recent years, artificial intelligence (AI) has reshaped industries across the globe, driving innovation and efficiency in various sectors. One of the most significant areas of transformation is the financial technology (FinTech) sector, where AI-based solutions are adaptable to an array of functions, notably in workflow management and automation. This article will delve into the latest trends, technical insights, and industry applications of AI Workflow Management in FinTech and how AI-based automation software is revolutionizing financial services.

.

**Emergence of AI in Financial Technology**

The FinTech industry has witnessed tremendous growth fueled by advancements in technology and increasing consumer demands for seamless digital experiences. According to a report from Allied Market Research, the global FinTech market is expected to surpass $300 billion by 2025. A substantial part of this transformation can be attributed to AI’s ability to enhance operational efficiency, manage workflows, and drive automation.

.

**AI-Based Automation Software: A Game-Changer for Workflow Management**

Workflow management, which entails the orchestration and optimization of processes within an organization, is receiving a profound overhaul through AI-based automation software. Traditional methods of managing workflows often fall short, hindered by manual interventions and legacy systems. By integrating AI into their operations, organizations can not only automate repetitive tasks but also leverage machine learning algorithms to optimize workflows based on real-time data analysis.

.

AI-based automation software leverages algorithms to enhance decision-making processes, facilitating a faster and more efficient workflow. This is particularly useful in the FinTech sector, where rapid decision-making is vital to maintaining competitiveness and regulatory compliance. In this dynamic environment, AI provides the necessary insights to manage workflow processes—from customer onboarding to fraud detection and risk management—streamlining operations while minimizing human error.

.

**Trends Revolutionizing AI Workflow Management**

1. **Robo-Advisors and Intelligent Investment Platforms**

The rise of robo-advisors has been one of the most pronounced trends in FinTech, driven by AI’s ability to analyze vast amounts of financial data seamlessly. These platforms automatically create investment portfolios tailored to individual client profiles by assessing risk tolerance, investment preferences, and market predictions. The deployment of AI algorithms in setting these portfolios ensures that clients benefit from data-driven insights while drastically reducing the manpower typically required for such services.

.

2. **Enhanced Risk Management Practices**

Regulatory compliance and risk management are non-negotiable components of any financial institution. AI-powered workflow management allows businesses to detect anomalies in transaction patterns, assisting in the identification of potentially fraudulent activities. By automating these checks, organizations can enhance their ability to respond to suspicious activities in real time, thereby improving customer trust and security.

.

3. **Natural Language Processing (NLP) and Customer Support**

Artificial intelligence is also transforming customer service models through natural language processing (NLP) technologies. AI-driven chatbots and virtual assistants integrate into financial institutions’ customer service frameworks, enabling 24/7 support for clients. These virtual assistants can handle routine customer inquiries, such as account information, transaction details, and loan applications, allowing human agents to focus on more complex tasks that require nuanced understanding and personalization.

.

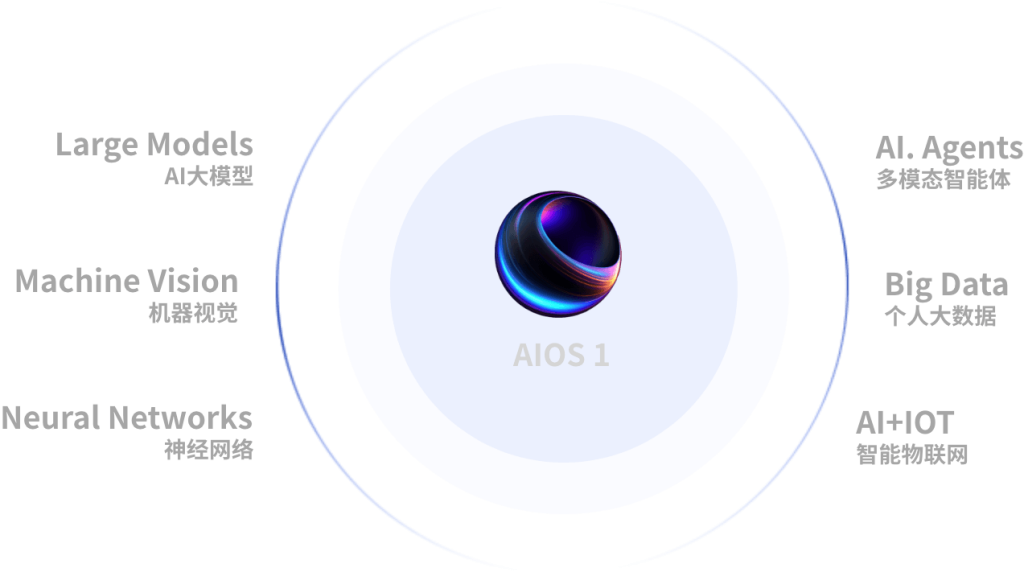

**Technical Insights into AI Workflow Management Solutions**

Implementing AI-based automation software requires substantial technical groundwork. Organizations looking to adopt these advanced solutions must prioritize integration with existing systems, data quality management, and the development of robust algorithms capable of understanding intricate financial structures. Key aspects include:

1. **Data Governance**

Data is at the core of AI-driven models. Establishing a comprehensive data governance framework ensures that data used for automation is accurate, complete, and relevant. This not only requires a well-defined data architecture but also strict adherence to data privacy regulations such as GDPR.

.

2. **Scalable Infrastructure**

FinTech firms should invest in scalable computational infrastructure capable of supporting the extensive data processing necessary for AI analytics. The cloud offers an ideal solution as it allows for on-demand resources that match varying workloads while maintaining operational flexibility.

.

3. **Continuous Learning and Adaptation**

AI models should be designed to evolve over time. Robust feedback loops facilitate continuous learning through data inputs derived from ongoing transactions. This adaptation is essential, especially in the financial landscape which is subject to swift changes due to market dynamics, consumer trends, and regulatory updates.

.

**Industry Use Cases and Success Stories**

Several organizations have successfully integrated AI-based workflow management solutions that underscore the potential of AI within the FinTech space. Notable examples include:

1. **ZestFinance**

ZestFinance is a leading player in alternative credit scoring, utilizing AI to analyze non-traditional data for assessing borrower risk. By employing predictive analytics and workflow automation software, the company can streamline lending processes and improve credit decision accuracy, enabling it to serve previously overlooked markets.

.

2. **Kabbage**

Kabbage is a FinTech company specializing in small business loans. By using AI algorithms to analyze real-time business data, Kabbage automates the entire application and funding process, thereby reducing the time frame from weeks to mere minutes. This capability not only enhances customer experience but provides businesses with swift access to needed capital.

.

3. **Ant Financial**

Ant Financial, a subsidiary of Alibaba Group, has leveraged AI for a myriad of functions in its payment and lending services. The implementation of sophisticated AI models in workflow management has enabled efficient customer onboarding, credit assessment, and risk monitoring. As a result, Ant Financial has become one of the world’s leading digital payment platforms.

.

**Final Thoughts: The Future of AI Workflow Management in FinTech**

As AI continues to advance, its integration into financial technology is poised to deepen. The capabilities of AI-based automation software will only expand, enabling FinTech firms to refine their workflow management practices further. By unlocking efficiencies, improving decision-making, and bolstering customer engagement, AI is set to become an indispensable asset in the financial industry.

.

For firms looking to stay ahead of the curve, investing in AI technology and developing robust automation ecosystems is essential. As seen through various industry applications and successful case studies, the potential for AI to transform workflow management is immense—redefining how financial institutions operate and deliver services in an increasingly digital world.

.

**Sources:**

1. Allied Market Research. “FinTech Market by Type, Application, and Region – Global Forecast 2025.”

2. ZestFinance. “How ZestFinance Uses Machine Learning to Reimagine Risk.”

3. Kabbage. “How We Work: The Kabbage Process.”

4. Ant Financial. “Ant Financial’s Technology and Innovation Journey.”