In today’s fast-paced digital landscape, industries across the globe are embracing innovative technologies to enhance efficiency and simplify operations. One of the most compelling advancements is **Full Work Automation**, particularly in sectors that demand precision and speed, like insurance. As businesses strive to meet customer expectations and adapt to rapid market changes, the integration of **AI-driven Decision Making** and **AI in Insurance Automation** emerges as a pivotal trend.

.

## Understanding Full Work Automation

**Full Work Automation** refers to the deployment of sophisticated technologies to manage workflows and processes without the need for human intervention. It encompasses a variety of tools, including robotic process automation (RPA), artificial intelligence (AI), machine learning (ML), and advanced analytics. The objective is not just to automate repetitive tasks but to create an intelligent framework that optimizes the entire operational ecosystem.

.

In the insurance sector, where the processing of claims, underwriting, and customer service are traditionally laden with manual operations, full work automation offers a transformative solution. It can reduce processing times, increase accuracy, and ultimately create a more streamlined customer experience.

.

## AI-Driven Decision Making in Insurance

**AI-driven Decision Making** takes automation a step further by infusing algorithms with the ability to analyze vast amounts of data and derive actionable insights. It can assess risks more accurately, evaluate claims faster, and personalize client interactions with unprecedented precision. Here’s how AI-driven decision-making is reshaping the insurance landscape:

1. **Enhanced Risk Assessment**: Insurers can utilize machine learning algorithms to analyze historical data, recognize patterns, and predict future risks. This enables them to adjust premiums more accurately and develop tailored insurance products.

2. **Streamlined Claims Processing**: AI can analyze claims data in real-time, flagging anomalies or potential fraud instantly. This cuts down on time spent manually reviewing claims and allows for quicker payouts, enhancing customer satisfaction.

3. **Predictive Analytics**: By leveraging historical data and market trends, AI helps predict client needs and behaviors, enabling insurers to offer personalized services that meet evolving client requirements.

.

According to a report by McKinsey, companies that fully integrate AI into their operations could see a 10% to 20% increase in productivity, affirming the necessity of AI-driven strategies in today’s competitive landscape.

.

## The Role of AI in Insurance Automation

The integration of **AI in Insurance Automation** is not only transforming operational efficiency but also reshaping customer interactions. Here are some practical applications of AI within insurance automation:

### 1. Intelligent Chatbots for Customer Service

Companies are increasingly deploying AI-driven chatbots to handle customer inquiries efficiently. These chatbots are capable of managing routine queries, resolving issues, and even initiating claims efficiently. This not only reduces operational costs but also ensures that clients receive instant support, enhancing the overall customer experience.

### 2. Automated Underwriting Processes

AI streamlines underwriting processes by analyzing vast data sets to determine eligibility and pricing automatically. Insurers can implement algorithms to assess an applicant’s risk level in real-time, speeding up the approval process and ensuring that policies are issued faster.

### 3. Smart Fraud Detection Systems

AI technologies, through machine learning capabilities, can identify unusual patterns that may indicate fraudulent activity. By monitoring transactions and claims in real time, AI can flag discrepancies for further investigation, significantly reducing losses related to fraud.

.

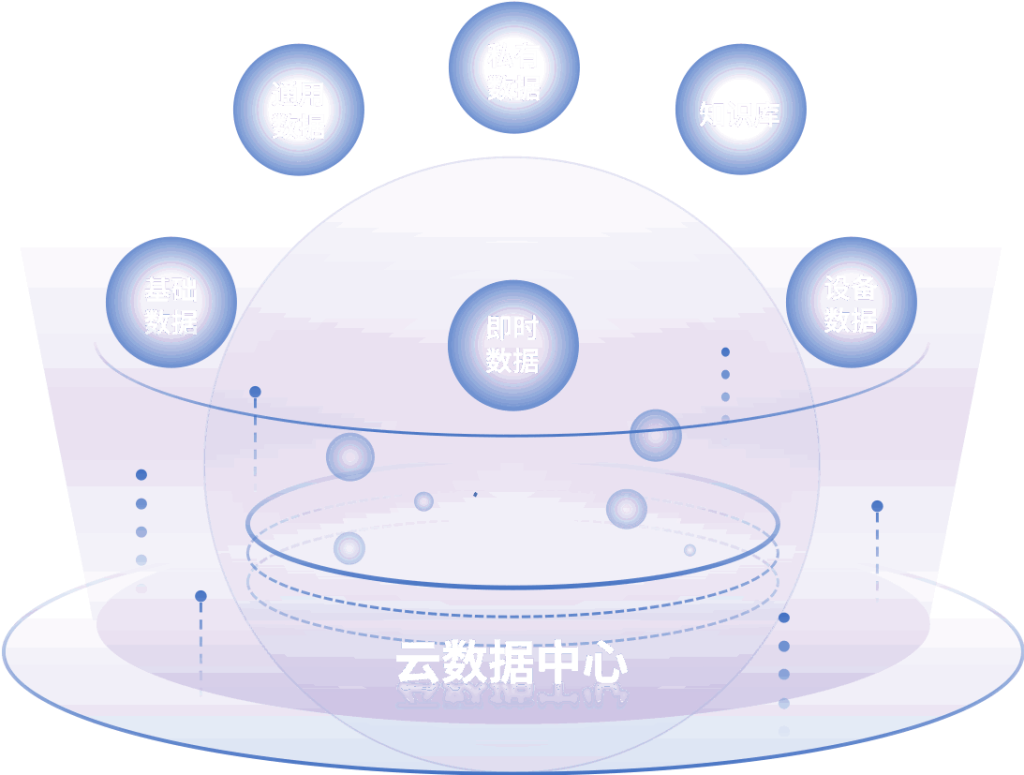

### 4. Data Management and Analysis

Insurance companies juggle massive amounts of data daily. AI can facilitate the organization, management, and analysis of this data, allowing for actionable insights to be derived. This means that data-driven decision-making becomes more integrated, empowering companies to make informed decisions swiftly.

### 5. Personalized Marketing Strategies

AI can analyze client data to determine preferences and behaviors, allowing insurers to create targeted marketing strategies. By understanding what products may be of interest to specific audiences, companies can improve their marketing efficiency and conversions.

.

## Insurance Industry Use Cases

The migration towards full work automation, supported by AI, is evidenced in several real-world applications within the insurance sector. Here are a few notable use cases:

### 1. Lemonade Insurance: AI-Powered Claims Processing

Lemonade Insurance employs AI algorithms to handle claims processing. Through its digital platform, customers can file claims using their mobile devices, and AI processes these in record time. This not only minimizes operational costs but also significantly enhances customer satisfaction, setting a new standard in the industry.

### 2. Allstate: Predictive Analytics for Risk Assessment

Allstate uses predictive analytics to assess the risk of providing coverage based on various factors, from customer behavior to market trends. By evaluating this data, Allstate can determine pricing models that promote profitability while also maintaining competitiveness in the market.

### 3. Zurich Insurance: Intelligent Automation for Customer Relations

Zurich Insurance has implemented intelligent automation technologies to better manage customer relations. By automating routine inquiries, representatives can focus on more complex issues, thereby enhancing service quality and client engagement.

.

## Future Trends in Full Work Automation

As the insurance sector continues to evolve, several trends in Full Work Automation are expected to shape its future:

### 1. Increased Integration of Blockchain

Blockchain technology may facilitate real-time, secure data sharing among insurers and clients, thereby enhancing trust and transparency in transactions. This can also streamline claim processes by providing a verifiable data trail.

### 2. Greater Emphasis on Compliance Automation

Regulatory compliance has always been critical in insurance. Companies are likely to invest in automated solutions that ensure adherence to compliance standards, mitigating risks and potential penalties.

### 3. AI-Powered Risk Management Tools

The evolution of AI-driven risk management tools will become more prominent. Insurers will rely on AI’s predictive capabilities to navigate and manage risks more effectively, rather than just reacting to incidents as they emerge.

.

## Conclusion: The Path Forward for Insurance Automation

The insurance industry stands at the cusp of a significant transformation, driven by Full Work Automation, AI-driven Decision Making, and tailored applications of AI. By embracing these changes, companies can enhance their operational efficacy, deepen customer relationships, and create a sustainable competitive edge.

As organizations continue to adapt to these advancements, the challenge lies not in the technology itself but in the strategic implementation of automation solutions. Success will require a balanced approach, integrating human expertise with the capabilities of AI to usher in an era of unprecedented efficiency and innovation.

.

### Sources

1. McKinsey & Company: “How AI Can Improve Operational Efficiency in Insurance.”

2. Deloitte Insights: “The Future of Insurance: Machine Learning’s Role.”

3. Accenture: “Insurance Technology Vision: The Future is Here.”

4. PwC: “Insurtech: Insurance Innovation in the Digital Age.”

5. Gartner: “Top Trends in Insurance Technology and Innovation.”