As businesses strive for efficiency, the integration of Artificial Intelligence (AI) into various sectors has emerged as a critical component of their operational strategies. Among these sectors, the insurance industry is currently undergoing a noteworthy transformation fueled by AI services, which offer new opportunities for automation, customer engagement, and overall operational effectiveness. This article delves into the latest trends, updates, industry applications, and technical insights regarding AI in insurance automation, spotlighting the intelligent workflows that are redefining the sector’s landscape.

.

## Current Trends in AI Services for Insurance

The use of AI services in the insurance industry is steadily gaining traction, with companies recognizing the potential benefits of automating various processes. This trend can be attributed to several factors, including the increasing demand for personalized customer experiences, the need for risk assessment, and the relentless pursuit of operational efficiency.

According to a recent report from McKinsey & Company, insurance firms that effectively implement AI services can expect to reduce operational costs by up to 30% within the next decade. AI can improve claims processing by utilizing machine learning algorithms capable of analyzing large volumes of data quickly and accurately. Natural Language Processing (NLP) tools are also being adopted to enhance communication between insurers and customers, ultimately leading to better service delivery.

.

## Intelligent Workflows: The Core of AI Automation

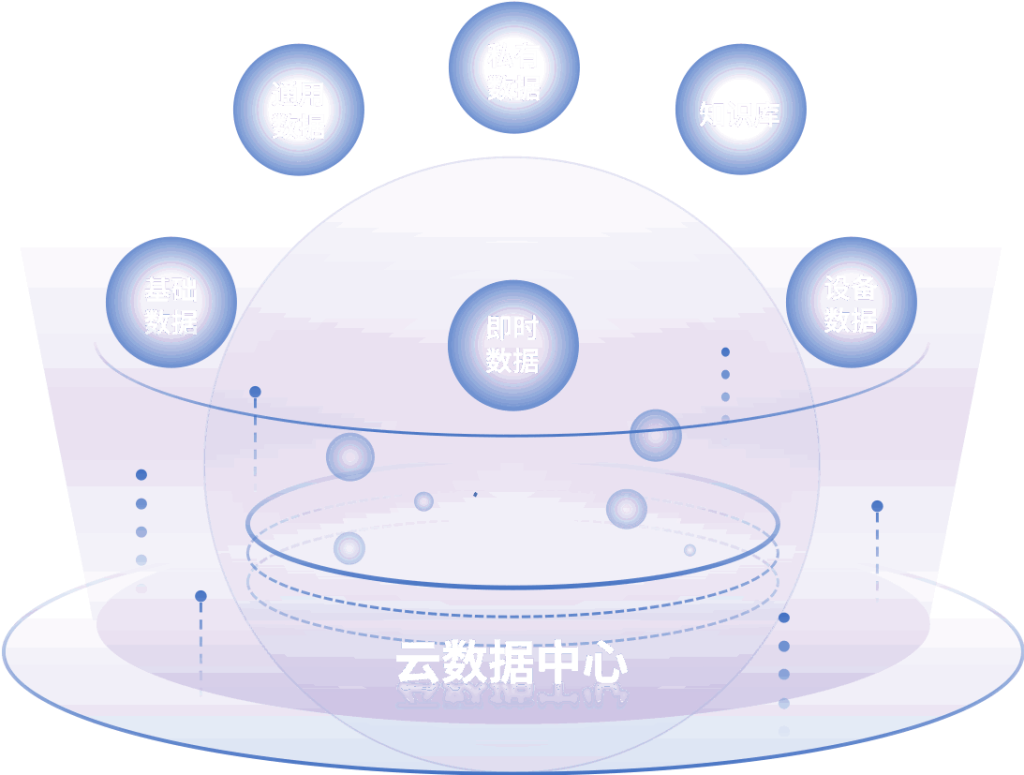

At the heart of AI in insurance automation lies the concept of intelligent workflows. Intelligent workflows leverage AI and data analytics to streamline processes, reduce manual intervention, and enhance decision-making capabilities. This is particularly vital in areas such as underwriting, claims processing, and customer service.

Intelligent workflows can automate repetitive tasks like data entry, fraud detection, and risk assessments. By using AI algorithms, insurers can analyze historical data to evaluate risks associated with new policies or claims accurately. Automation can also facilitate quicker claim settlements, enhancing overall customer satisfaction.

.

## Key Applications of AI in Insurance Automation

### 1. Underwriting Enhancement

The underwriting process, critical to assessing risk and determining premiums, has been revolutionized by AI services. Through data analysis, insurers can accurately predict risks associated with individual policyholders. For instance, AI can analyze data from various sources such as social media, IoT devices, and customer interactions to make informed underwriting decisions.

By employing predictive analytics, underwriters can evaluate applications faster and more accurately than ever before. Furthermore, the integration of AI can significantly decrease the time it takes to underwrite complex cases, thereby increasing efficiency and reducing costs.

### 2. Claims Processing Optimization

Claims processing remains one of the most vital and transaction-heavy operations in the insurance sector. Traditional claims processing methods are often slow and labor-intensive, leading to customer dissatisfaction. AI-driven solutions are transforming this landscape.

AI-powered chatbots can provide real-time support to customers filing claims, guiding them through the process while reducing the dependency on human support. Such systems utilize NLP to interpret customer concerns and can route claims to the appropriate department, expediting initial assessments.

Additionally, image recognition technology enables insurers to evaluate damages more quickly. For example, customers can upload images of vehicle damages from accidents, which can then be automatically assessed by AI algorithms to determine the extent of the damage and the estimated claim.

### 3. Fraud Detection and Prevention

Fraudulent activities can significantly impact insurers’ bottom lines. To counter this, AI services offer robust solutions for fraud detection and prevention. Using advanced machine learning techniques, insurers can analyze historical claims data and identify patterns indicative of potential fraud.

These systems can flag suspicious claims for further investigation. According to a study by the National Insurance Crime Bureau, the integration of AI has led to a 25% increase in the detection of fraudulent claims in the insurance sector, proving its effectiveness in maintaining the integrity of insurance processes.

### 4. Personalized Customer Engagement

Personalization has emerged as a critical expectation among consumers across many industries, and insurance is no exception. AI services enable insurers to offer tailored products and services that meet individual needs.

Through the analysis of customer data, AI can identify preferences and behaviors, allowing insurers to design customized offerings. Chatbots and virtual assistants further enhance customer support by providing personalized assistance, answering queries, and guiding them to the right products based on their unique profiles.

.

## Technical Insights: How AI Works in Insurance Automation

Understanding the technical framework that supports AI services in insurance automation is crucial for industry stakeholders. Various technologies play a role in the successful implementation of AI, including machine learning, natural language processing, and big data analytics.

### Machine Learning (ML)

Machine learning algorithms enable insurers to analyze vast datasets quickly and derive insights that inform decision-making processes. ML can identify correlations and trends within claims data, underwriting profiles, and customer interactions that human analysts may not readily discern.

The iterative nature of machine learning allows these systems to continuously improve, meaning that as more data is fed into the algorithms, their predictive accuracy also increases. This is instrumental in reducing risk and enhancing efficiency across the board.

### Natural Language Processing (NLP)

Natural Language Processing is vital for automating customer interactions and processing unstructured data. NLP systems can understand and generate human-like text, allowing insurers to automate communications via chatbots or automated emails.

Insurance companies can employ NLP to analyze customer feedback obtained from surveys, social media, and reviews, which can be invaluable for enhancing services and identifying areas needing improvement.

### Big Data Analytics

Big data analytics plays a significant role in insurance automation. The insurance sector generates vast amounts of data from various sources, such as customer interactions, claims, and market research. AI services leverage this big data to identify trends, enhance risk assessment models, and develop customized insurance products.

By employing data visualization tools and predictive modeling, insurers can glean actionable insights that inform their strategies and improve operational effectiveness.

.

## Industry Use Cases: Real-world Examples of AI in Action

Several forward-thinking insurance companies are paving the way in the adoption of AI services.

**1. Lemonade**: Known for its innovative approach to insurance, Lemonade utilizes AI to process renters and homeowners insurance claims in record time. With its AI chatbot “Maya,” the company can evaluate claims and initiate payments in as little as three minutes, illustrating the power of intelligent workflows.

**2. Allstate**: Allstate has been at the forefront of implementing AI-driven analytics in its underwriting processes. By analyzing telematics data from drivers, the company can assess risk more accurately, resulting in personalized premium adjustments that reflect individual driving behaviors.

**3. Zurich Insurance**: This global insurer has integrated AI to optimize customer service and claims processing. By employing chatbots powered by NLP, Zurich is able to expedite responses and support for customers filing claims, significantly enhancing customer experience and operational efficiency.

.

## Conclusion

The integration of AI services and intelligent workflows into the insurance industry is more than just a trend—it’s a transformative movement set to redefine operational approaches and customer interactions. By embracing these technologies, insurance firms can achieve enhanced efficiency, improved risk assessment, and exceptional customer experiences. The use cases presented above underscore the immense potential of AI in insurance automation, illustrating its capacity to streamline operations and foster customer engagement.

As the industry continues to evolve, it is essential for insurance companies to remain agile and invest in AI technologies to stay ahead of the competition and meet growing consumer demands. The future of insurance lies in harnessing the power of AI to create smarter, more efficient workflows that benefit both providers and customers.