The financial industry is undergoing a transformative change as artificial intelligence (AI) continues to evolve. Among the most exciting developments is the emergence of multimodal AI-agents, which are capable of processing various forms of data—text, images, audio, and more—simultaneously. This article dives deep into the significance of multimodal AI-agents, their impact on finance automation, and their role in AI-driven process reengineering.

.

## Understanding Multimodal AI-Agents

Multimodal AI-agents are designed to handle and integrate multiple types of data inputs. Traditionally, AI systems have focused on either natural language processing (NLP) for text or computer vision for images. However, multimodal AI-agents combine these modalities, which allows for more comprehensive decision-making capabilities. In finance, for example, agents can analyze textual reports, images of financial documents, and even audio snippets from meetings to derive insights that were previously unattainable with unidimensional AI.

.

## The Rise of AI in Finance Automation

Finance is among the sectors most ripe for innovation through automation. According to a recent report by Deloitte, about 47% of financial services professionals predict that AI will play a significant role in their industry by 2025. Automation in finance involves using AI to streamline various tasks, from data entry to risk assessment and customer service.

.

### Benefits of AI-Driven Automation

1. **Increased Efficiency**: AI can work much faster than human employees, drastically reducing the time it takes to process transactions and analyze data. A study by McKinsey indicates that automating just 40% of transactional activities could yield an efficiency boost of up to 30%.

2. **Enhanced Decision-Making**: With the ability to analyze vast arrays of data from different formats, multimodal AI-agents provide deeper insights that enable better decision-making. For instance, they can deliver a real-time risk assessment by tailoring their analysis through various data modalities.

3. **Cost Reduction**: By replacing manual processes with AI-driven automation, companies can minimize labor costs and reduce human error, saving millions in operational expenses.

4. **Improved Customer Experience**: AI-driven chatbots can provide instant customer support. With multimodal capabilities, these systems can connect to various data streams, providing personalized advice based on past interactions and real-time data.

.

### Industry Applications of AI in Finance

The applications of AI in finance are vast and varied. Some common use cases include:

– **Risk Management**: Multimodal AI-agents can assess market trends, customer behaviors, and external factors (like geopolitical conditions) by processing graphics, audio, and text from reports simultaneously.

– **Fraud Detection**: By integrating various data types, these agents can identify unusual patterns that hint at fraudulent activities, thus significantly enhancing the ability of financial institutions to combat fraud.

– **Automated Financial Advisory**: Robo-advisors that use multimodal AI can analyze social media sentiment, news articles, as well as visually presented financial documents to provide holistic investment advice.

.

## Technical Insights into Multimodal AI-Agents

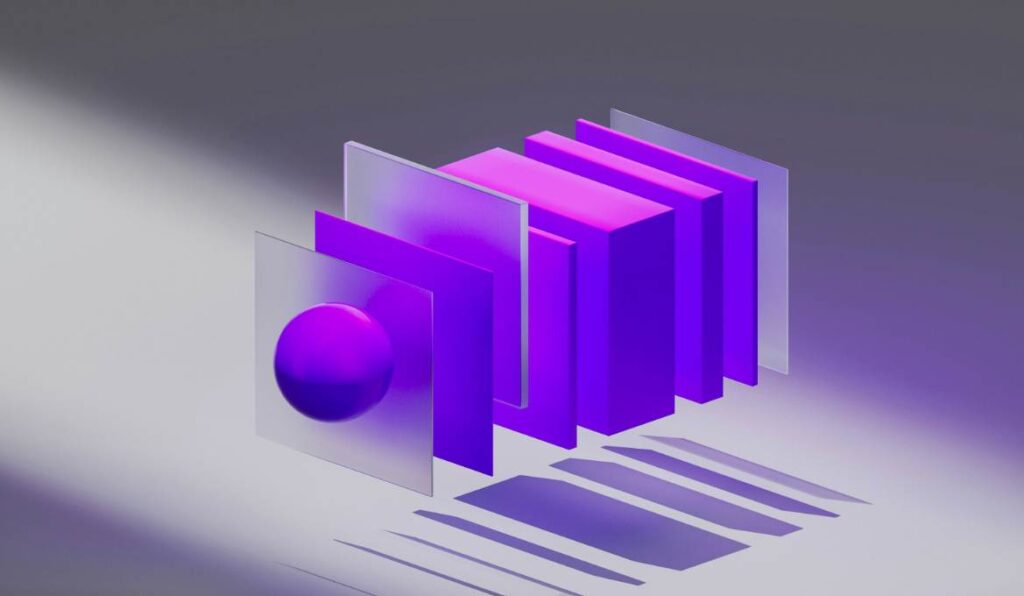

Building effective multimodal AI-agents involves sophisticated algorithms and architectures. Modern AI systems typically deploy neural networks designed for each specific modality. However, what sets multimodal systems apart is the integration mechanism that allows these neural networks to communicate and share insights.

.

### Key Components

1. **Data Fusion Strategies**: This is crucial in helping the system understand the relationships between different data types. Techniques like late fusion (where outputs from different modalities are combined at the decision level) and early fusion (where data from all modalities is combined before processing) are commonly used.

2. **Transfer Learning**: By utilizing pretrained models on various data types, developers can save time and resources while improving the models’ performance.

3. **Interpretable AI**: In finance, transparency is paramount. Multimodal AI-agents must be interpretable to explain decisions to regulators and clients clearly. Research in this area focuses on creating models that can articulate the reasoning behind their output.

.

## AI-driven Process Reengineering in the Financial Domain

Process reengineering involves rethinking how work is done to better support an organization’s mission and reduce costs. With the introduction of AI technologies, this process can be accelerated and enhanced significantly.

.

### The Role of AI in Process Reengineering

1. **Workflow Optimization**: AI can help identify bottlenecks in existing processes and suggest improvements that streamline workflows. Using data collected from various departments, multimodal agents can pinpoint inefficiencies across silos.

2. **Predictive Analytics**: By analyzing historical data, AI can provide forecasts that inform strategic planning, investment decisions, and customer relations.

3. **Continuous Improvement**: AI systems learn and adapt over time. Thus, ongoing reengineering initiatives can benefit from AI’s continuous enhancement capabilities.

.

### Case Studies

In 2022, Deutsche Bank implemented AI-driven process reengineering strategies aimed at increasing their transaction processing speed by 40%. By leveraging multimodal AI-agents, they integrated visual analyses of market trends with automated workload distribution processes that improved operational efficiency.

Similarly, a fintech startup developed a multimodal AI-agent that improved its fraud detection capabilities by 70%, combining data from transactions, customer profiles, and social media sentiment. This allowed them to catch anomalies that traditional systems missed.

.

## Conclusion: The Future of Multimodal AI in Finance

The integration of multimodal AI-agents within finance automation signifies the dawn of a new era. As financial institutions continue to recognize the immense potential of AI-driven process reengineering, they will be better positioned to tackle today’s challenges and thrive in an increasingly complex market.

.

As we advance, understanding how to effectively harness these technologies will be crucial. Continuous research, collaboration, and ethical considerations will shape the landscape of finance and ensure that AI is a tool for empowerment, not subjugation.

.

In summary, the convergence of these cutting-edge technologies is not merely a trend but a necessary evolution that will redefine the architecture of financial services for years to come.

.

### References

1. Deloitte Insights. (2023). “The Future of AI in Financial Services.”

2. McKinsey & Company. (2023). “How AI Is Transforming the Finance Sector.”

3. Financial Times. (2023). “AI-Powered Fraud Detection: A Case Study in Fintech Innovation.”

4. Springer Nature. (2023). “Interpretable AI in Finance: Challenges and Solutions.”