In an era where businesses face a complex web of regulations, compliance automation through Artificial Intelligence (AI) is becoming increasingly vital. The application of AI in compliance automation streamlines processes, reduces human error, and enhances regulatory adherence across various industries. .

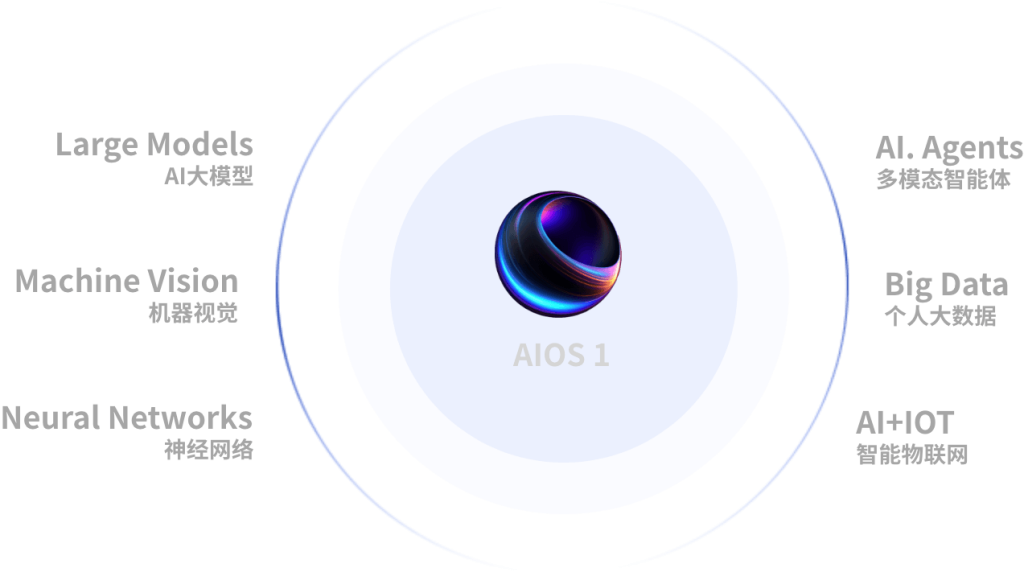

The compliance landscape is evolving, with organizations adopting digital tools that leverage AI technology. These tools can assess vast amounts of data in real-time, identify irregularities, and ensure that companies adhere to the latest regulatory requirements. The ability of AI to process and analyze data far surpasses that of traditional methods, enabling firms to maintain compliance while focusing on core business functions. .

Leading compliance service providers have integrated AI into their solutions, offering businesses advanced tools that include predictive analytics, natural language processing, and machine learning algorithms. These innovations help organizations automate mundane tasks such as document verification, risk assessment, and transaction monitoring, thus freeing up valuable human resources for more strategic initiatives. .

A significant trend driving AI adoption in compliance is the increasing regulatory scrutiny businesses are facing. The consequences of non-compliance can be detrimental, including hefty fines, legal repercussions, and reputational damage. According to a report by the global consulting firm PwC, 88% of organizations view compliance as an essential element of their overall business strategy. As such, using AI to bolster compliance processes has never been more relevant. .

Moreover, the integration of AI not only enhances compliance efficacy but also fosters a culture of proactive risk management. Organizations can leverage AI-driven insights to anticipate regulatory changes, allowing them to adapt quickly and remain compliant. Firms like NICE Actimize and IBM Watson have developed AI tools aimed at automating compliance workflows, significantly reducing operational risks and costs. .

In tandem with compliance, businesses are also recognizing the role of AI in financial technology (FinTech). By automating compliance processes, FinTech firms can offer more reliable and secure services, thereby gaining customer trust and expanding their market reach. .

**AI in Financial Technology (FinTech): Transforming the Financial Services Landscape**

Artificial Intelligence is redefining the FinTech industry, ushering in a new era of efficiency, customer personalization, and risk management. With AI’s capabilities to analyze big data, detect patterns, and provide predictive insights, financial institutions are transforming their service offerings, ensuring they remain competitive in a rapidly evolving market. .

AI-enabled technologies such as chatbots, robo-advisors, and credit risk assessment tools are reshaping how financial services are delivered. For instance, chatbots can handle customer inquiries 24/7, providing instant support and improving customer satisfaction. Robo-advisors use algorithms to offer personalized investment advice based on individual preferences and financial goals, democratizing access to sophisticated financial planning solutions. .

Risk management is another critical area where AI has made significant inroads. By employing machine learning models, financial institutions can assess creditworthiness more accurately, minimizing the risk of loan defaults. This technology analyzes historical transaction data, social media activity, and even online behavior patterns, providing a holistic view of a potential borrower’s risk profile. According to a McKinsey report, organizations that employ AI in risk management can reduce fraudulent activities by up to 50%. .

Furthermore, AI streamlines operational processes in FinTech firms. From automating routine tasks to enhancing decision-making, AI technologies bring efficiency and cost-effectiveness to business operations. For example, automation of back-office functions such as KYC (Know Your Customer) processes can dramatically cut the time required to onboard new clients, thereby improving the user experience. .

Regulatory pressures in the FinTech sector are also driving the uptake of AI. With compliance costs rising, automated solutions powered by AI are helping businesses navigate complex regulations more effectively. Technologies that can automatically assess new regulations and their implications for the business model not only enhance compliance but also facilitate strategic planning. .

Overall, AI is a transformative force within the FinTech landscape, enabling financial institutions to provide more efficient and personalized services while managing risks effectively. With predictions suggesting that the global AI in FinTech market will reach $22.6 billion by 2025, the adoption of AI technology in financial services is set to accelerate further. .

**AI in Legal Automation: Revolutionizing the Legal Industry**

The legal sector is witnessing a profound transformation through the application of AI in legal automation. By automating routine and repetitive legal tasks, AI systems free up legal professionals to focus on more complex responsibilities, thus improving the overall efficiency and effectiveness of legal services. .

AI tools can perform tasks such as document review, contract analysis, and legal research with remarkable speed and accuracy. For example, machine learning algorithms can analyze thousands of documents in a fraction of the time it would take a human, significantly reducing the time spent on due diligence and legal reviews. .

Natural language processing (NLP) plays a crucial role in transforming legal documents into structured data that can be easily analyzed. Legal research platforms like ROSS Intelligence and Casetext use AI to deliver relevant case law and statutes, enabling lawyers to find the information they need quickly. This not only saves time but also enhances decision-making processes within legal practices. .

Moreover, AI-powered predictive analytics are gaining traction in legal automation. By analyzing past case outcomes and litigation trends, legal professionals can make more informed predictions regarding the potential outcomes of cases. This can lead to more strategic decision-making and improves clients’ chances of success in litigation. .

Another area where AI is making waves is contract lifecycle management. Legaltech solutions now employ AI to automate the drafting, review, and monitoring of contracts. This reduces the risk of human error and ensures that organizations stay compliant with contractual obligations. Companies like Kira Systems and Luminance specialize in providing AI-driven contract analysis tools that streamline these processes. .

Despite the numerous benefits, the integration of AI in legal automation is not without challenges. Concerns regarding data privacy, security, and the ethical implications of relying on AI in legal decision-making persist. However, law firms that embrace AI technology can achieve significant competitive advantages, positioning themselves as innovative leaders in the market. .

As legal automation continues to evolve, collaborative partnerships between AI developers and legal professionals are essential to ensure that technological advancements align with industry standards and ethical considerations. This synergy will help the legal sector leverage AI effectively and responsibly, driving the future of legal practice. .

**Conclusion: The Future of AI in Compliance, FinTech, and Legal Automation**

The integration of Artificial Intelligence in compliance automation, financial technology, and legal automation heralds a new age for businesses across industries. By facilitating compliance, enhancing operational efficiency, and delivering personalized services, AI is transforming the regulatory, financial, and legal landscapes. .

As organizations embrace AI, they unlock the potential for improved decision-making and risk management, allowing them to navigate the complexities of modern business with greater agility and confidence. The future of these sectors is tied to the ongoing evolution of AI technologies, making it imperative for businesses to adopt and adapt to these groundbreaking changes. .

For organizations, the key to success will be finding the right AI solutions that align with their goals and navigating the challenges of implementation responsibly. As the demand for advanced technology grows, embracing AI in compliance, FinTech, and legal professions is not just a competitive advantage; it is rapidly becoming a necessity. .

**Sources:**

1. PwC. (2021). “Global Economic Crime and Fraud Survey.”

2. McKinsey & Company. (2020). “The State of AI in Financial Services.”

3. Forbes. (2020). “The Future of Legal Tech: An AI Perspective.”

4. Deloitte. (2021). “2021 FinTech Trends.”

5. Business Insider Intelligence. (2022). “The Future of AI in Finance.”