The insurance industry has long been viewed as a traditional sector, but in recent years, it has been undergoing a significant transformation fueled by advancements in technology, particularly in artificial intelligence (AI). Insurance automation powered by AI technologies has not only streamlined operational processes but also enhanced customer experiences and improved risk assessment practices. This article delves into the current trends surrounding AI in insurance automation, the impact of AI-based predictive modeling, and an evaluation of tools like Runway ML in transforming underwriting processes.

A significant driving force behind the adoption of AI in the insurance industry is the necessity for operational efficiency. Traditional insurance processes often involved cumbersome paperwork, time-consuming manual reviews, and prolonged claim management. By automating these processes, insurers are able to reduce operational costs and improve the speed of service delivery. AI optimizes back-end operations through automation tools that manage tasks ranging from customer inquiries to claims processing, empowering staff to focus on higher-value tasks, such as personalized customer interaction.

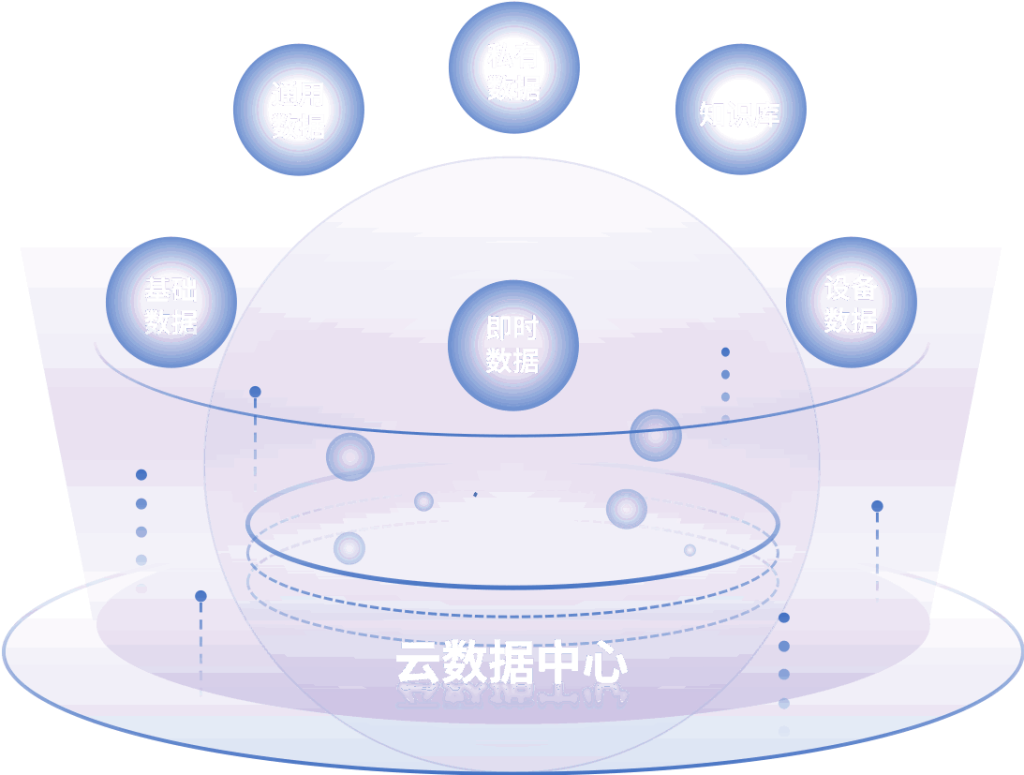

The concept of AI-based predictive modeling is a game-changer in the insurance sector. Predictive models leverage data analytics and machine learning algorithms to analyze historical data, uncovering trends and patterns that can predict future events. In insurance, predictive modeling is particularly valuable for risk assessment and underwriting processes. Insurers can utilize these models to identify high-risk clients, determine premiums accurately, or forecast potential claims. For instance, by analyzing customer data such as demographics, credit history, and lifestyle information, insurers can create better risk profiles and adjust their offerings accordingly.

. As the adoption of machine learning and AI technology has continued to grow, the recent development of platforms like Runway ML has enabled insurers to harness the power of AI without needing extensive technical expertise. Runway ML is a versatile platform that brings machine learning capabilities to various industries, including advertising, video editing, and even insurance. It allows insurance professionals to create and deploy machine learning models quickly, enabling them to analyze vast datasets and automate routine tasks seamlessly.

. The application of AI in risk assessment processes is not only beneficial for insurers but also for policyholders. Enhanced predictive modeling enables insurers to offer personalized policies tailored to individual risk profiles, thus creating a win-win situation. For instance, usage-based insurance models utilize data from policyholders’ behavior to calculate premiums, aligning pricing with actual risk factors. This approach leads to more accurate risk assessment and can drive down costs for low-risk customers while ensuring fair pricing for all.

AI’s integration into claims management can also revolutionize the insurance landscape. Utilizing AI for claims processing can significantly enhance accuracy and reduce the time required to settle claims. Natural Language Processing (NLP) and image recognition technologies can be leveraged to assess claims swiftly and accurately. For example, insurers can use AI to analyze photographs of damages submitted by clients to assess the severity of the claim and streamline the approval process. This not only speeds up the claims process but improves customer satisfaction by allowing quicker resolution of issues.

. Yet, as with any technological advancement, there are challenges associated with the implementation of AI in insurance automation. Chief concerns typically revolve around data privacy, model bias, and regulatory compliance. Insurers need to ensure they manage sensitive customer data in accordance with regulations like GDPR while also addressing the potential for algorithmic bias that could affect how certain customer segments are treated. Transparency in AI decision-making processes is paramount for maintaining customer trust and adherence to ethical standards.

Another trend shaping AI in the insurance landscape is the rising importance of customer experience. Insurers increasingly rely on AI-driven chatbots and virtual assistants to engage with customers and provide 24/7 support. These tools can handle inquiries, guide customers through the claims process, and deliver personalized policy recommendations based on individual customer data. According to a recent report by Accenture, companies that invest in AI to improve customer interactions can achieve an increase in customer satisfaction ratings of up to 40%.

. The future of AI in insurance automation appears promising, with continuous advancements in AI technologies and their growing acceptance in the sector. As companies strive to incorporate AI innovations into their operations, we can expect to see increased use of blockchain for secure data sharing, machine learning for enhanced fraud detection, and augmented analytics for better business intelligence.

Moreover, the use of more advanced AI technologies, such as Runway ML, will empower insurance professionals to create customized solutions quickly and effectively. The proliferation of user-friendly platforms will enable smaller firms to compete with larger insurance companies by allowing them access to sophisticated modeling tools that were previously only available to well-resourced players in the market.

Industry use cases illustrate the practical applications of AI in the insurance space. For instance, Progressive Insurance utilized predictive modeling to assess risk more accurately, resulting in significant reductions in fraudulent claims. Similarly, Lemonade, a startup in the insurtech realm, employs AI to provide instant quotes and claims processing, setting new standards for customer engagement and service efficiency. These use cases highlight how AI-driven technologies can reshape the competitive landscape of the insurance industry.

. In conclusion, the integration of AI in insurance automation is not merely an emerging trend but a fundamental shift that signifies a new era for the industry. By embracing AI-based predictive modeling, insurers can enhance their risk assessment capabilities, improve customer experiences, and drive operational efficiencies. Additionally, platforms such as Runway ML open new avenues for innovation, enabling insurance professionals to develop customized AI solutions that meet evolving market demands.

As the industry continues to adapt to these changes, it is imperative for insurance professionals to remain abreast of these trends and actively invest in AI technologies. The potential for growth is immense, and companies that strategically embrace AI will position themselves for long-term success in an increasingly digital world.

**Sources**

1. Accenture. (2021). “The Future of Insurance: Reimagining Customer Experience.”

2. McKinsey & Company. (2022). “How AI is Transforming the Insurance Industry.”

3. Eling, M. and Lehmann, M. (2020). “InsurTech: Big Data in Insurance.”

4. Runway. (2023). “Introducing Runway ML: Bringing AI to Creative Professionals.”

5. Progressive Insurance. (2021). “Using Predictive Modeling to Combat Fraud.”